In January 2026, the Australian Taxation Office (ATO) introduced a new strategic approach to assessing income tax audit risk in the property development sector. While the full scope of this approach remains unclear, the ATO will provide further details over the coming months.

On 14 January 2026, the ATO published Tax Alert TA 2026/1, “Contrived property development arrangements between related parties that defer recognition of income and exploit tax losses” (2026 Tax Alert), outlining anti-avoidance rules that may apply to parts of the industry.

The 2026 Tax Alert provides the following ATO intentions for 2026:

“We are currently reviewing certain property development arrangements between related parties involving long-term construction contracts that appear to be designed to create an artificial mismatch between the recognition of income from the property development activity and deductions claimed for the costs of development, such that tax on the profits may be indefinitely deferred. The losses generated are utilised within the group to obtain a tax advantage.”

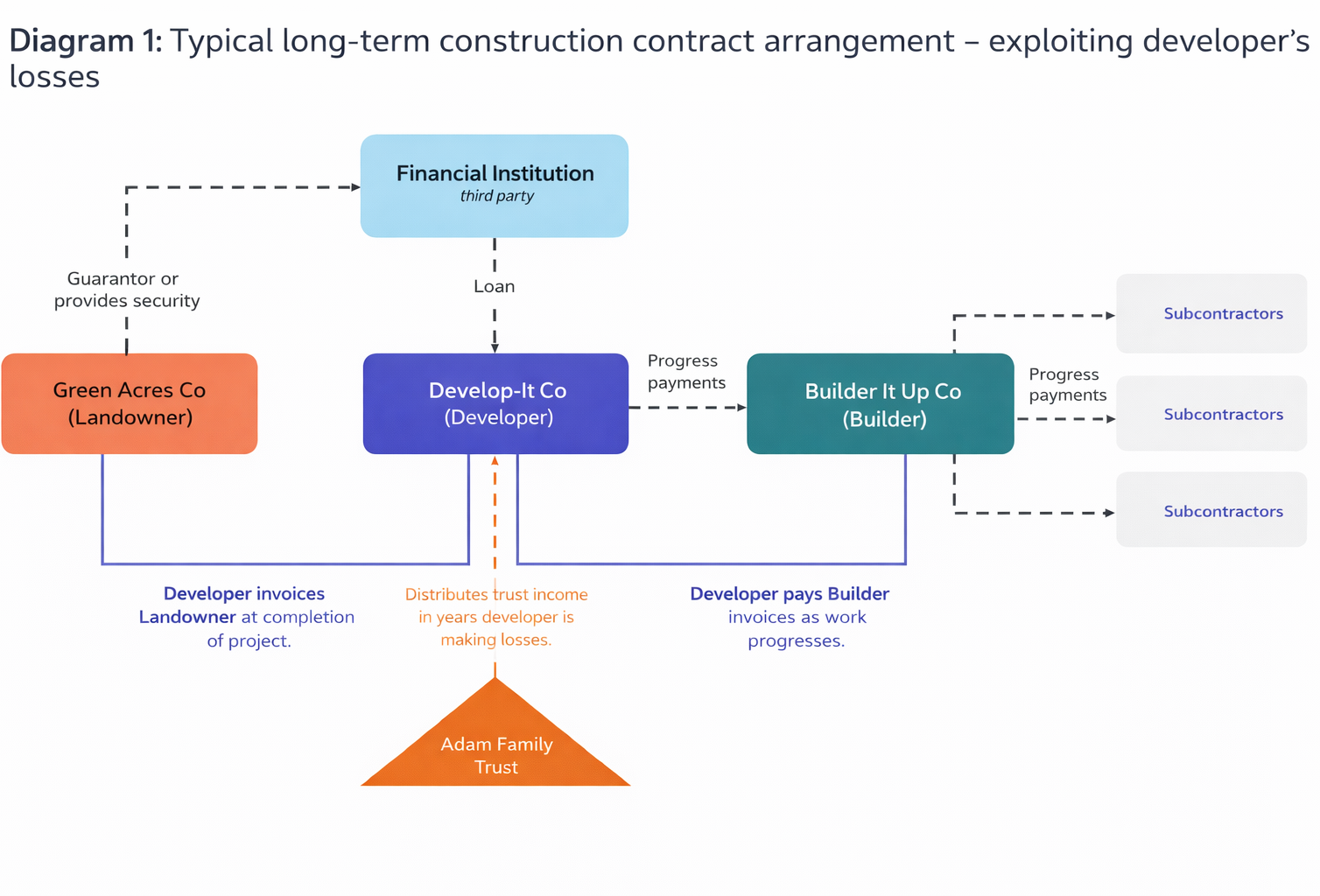

“In these arrangements, a special-purpose developer entity (developer) is interposed between the entity that owns the land being developed (landowner) and the entity undertaking building and construction works on the land (builder). The interposition of the developer artificially separates the land-ownership and development activities, which are, in substance, a single economic activity of property development.”

This publication provides the key features of the current ATO interest and outlines practical steps taxpayers may consider when reviewing similar arrangements.

The 2026 Tax Alert notes that certain long-term construction contract arrangements “may be considered a scheme” under the anti-avoidance tax rules and provides a single example of such a potentially tax avoidance arrangement:

The arrangement is described in the 2026 Tax Alert as follows:

Adam controls several entities (Adam’s economic group). An entity in Adam’s economic group, Green Acres Co., owns land acquired for development. Prior to the commencement of development of the land, Adam establishes a special-purpose company, Develop-It Co, which will be responsible for conducting the development activity. Adam is the company’s director, and he and his wife each hold 50% of the shares. Develop-It Co then enters into a PDA with Green Acres Co.

A contract between the parties sets out their respective responsibilities and payment obligations. Under the terms of the contract, Develop-It Co is entitled to invoice Green Acres Co progressively for the development services. The PDA’s service life is expected to be three years.

Develop-It Co has no employees and holds minimal assets, so it cannot undertake the development without funding from another party. The funds are borrowed from a financial institution. Green Acres Co’s land is put up as security for the loan provided to Develop-It Co.

Develop-It Co contracts with Build-It-Up Co (an unrelated company) to carry out the physical construction work. Develop-It Co incurs construction costs and pays Build-It-Up Co progressively over the project duration, and in turn, claims tax deductions for those costs as they are incurred. However, Develop-It Co chooses not to invoice Green Acres Co for the development services it provides on a progressive basis.

This mismatch between income earned and deductions claimed on the property development activity results in Develop-It Co generating tax losses. These losses are utilised over the life of the development, offsetting distributions of income from the Adam Family Trust.

In the final year of development, Adam establishes a new company within the group to acquire an additional parcel of land for development. This company enters into a PDA with Develop-It Co so that when Develop-It Co recognises the income from the development of Green Acres Co, losses are incurred to offset that income. Adam replicates this structure across multiple consecutive or concurrent projects, which results in the perpetual deferral of tax on group profits, potentially indefinitely.

In relation to the above, the ATO concerns are:

- That related parties undertaking these arrangements are, in substance, undertaking a single economic activity of property development, yet have artificially separated landownership and development activities to gain a tax advantage.

- That the arrangements are contrived and designed to artificially separate the landownership and development activities to:

- Inappropriately manipulate the application of the trading stock provisions under Division 70 of the Income Tax Assessment Act 1997 by the landowner entity.

- Inappropriately defer the recognition of income by the developer entity.

- Generate artificial losses in the developer entity that are used to offset other income within the economic group, leading to reduced tax or no tax being paid.

- With repeated use of the arrangement in a deliberate manner, ensure reduced tax or no tax being paid some times indefinitely.

In 2026, the ATO will publish an accompanying Practical Compliance Guide that will further expand on the increased ATO audit risk for certain property developers. When the PCG is published, some of the above concerns should be addressed.

Furthermore, as currently published, the circumstances of the 2026 Tax Alert example are also too generic for practical application, as there is no consideration of the size or scale of the long-term construction project – e.g., is the project a large-scale infrastructure project, a commercial warehouse or merely the continuous construction on multiple sites of two residential townhouses. Given the upcoming PCG, some of the above concerns should be addressed by the ATO this year.

The ATO 2026 Tax Alert does not identify the non-tax consideration the ATO would consider if Part IV and anti-avoidance rules would apply, including for example, the intention to eliminate insolvency risk, asset protection risk, quarantining construction dispute risk and other commercial risks that may exist in a long-term project and via the adoption of suitable interposed legal entities in corporate structures.

When published, we will provide an update regarding the proposed ATO Practical Compliance Guide to be issued by the ATO in 2026.

This publication serves as a timely reminder to review past, present and future property development structures and assess any associated tax risks in light of the ATO’s updated strategic focus in 2026.

Next steps

If you have any questions about the topics discussed in this article or require guidance on past, present, or future property development projects, speak with your trusted Nexia Advisor to explore tax obligations and potential opportunities.