The ATO has released new guidelines contained in Practical Compliance Guide 2023/1 for taxpayers claiming home office expenses. The revised fixed rate method applies from 1 July 2022 and the changes are only related to the claiming of additional running expenses and the cost of purchasing assets incurred as a result of working from home. The new guidelines do not cover occupancy expenses such as rent, mortgage interest, property insurance.

What are the Key Changes?

New Method of claiming home office deductions:

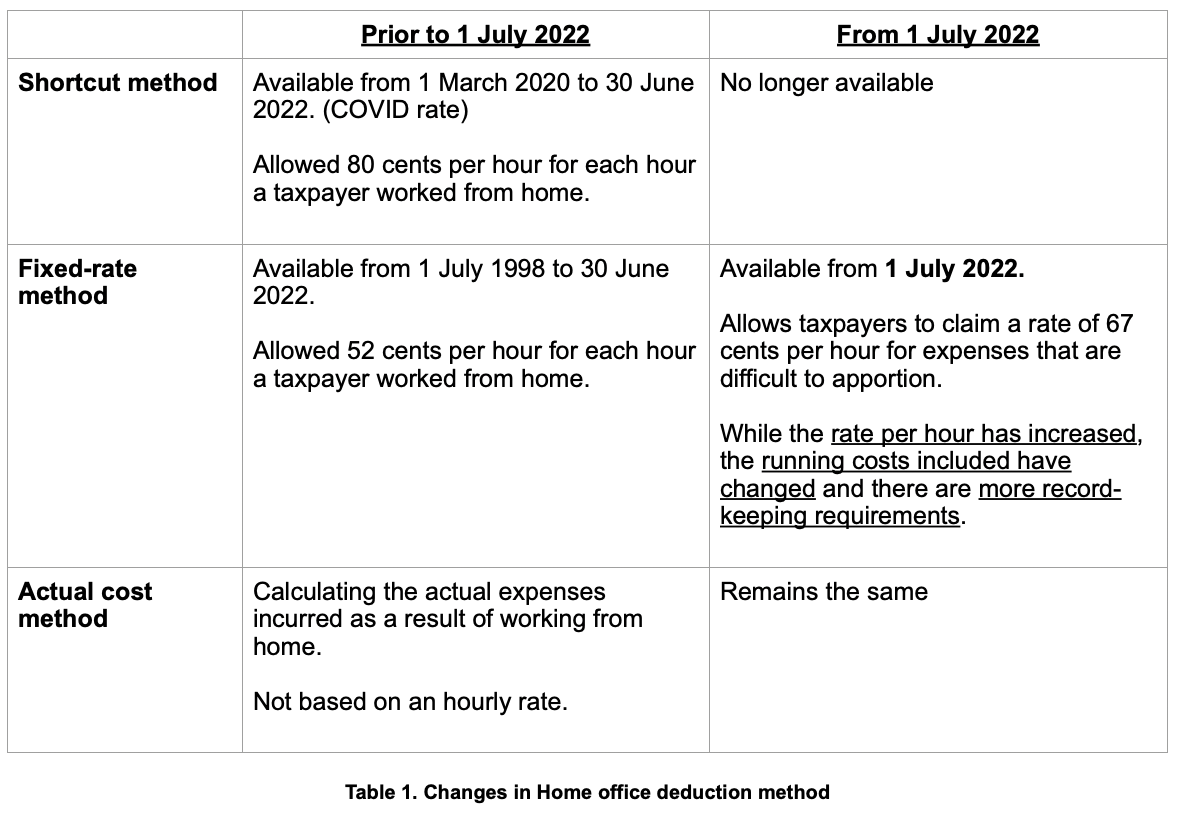

As illustrated in the Table 1, the ATO have replaced the Fixed Rate Method of 52 cents per hour with a 67 cents per hour flat rate that apportions the following additional running expenses:

- Energy expenses (electricity and gas) for lighting, heating, cooling and electronic items used while working from home.

- Internet expenses

- Mobile and home phone usage

- Stationery and computer consumables.

*The rate per hour calculates the total of the above expenses for the income year, which means you CANNOT claim an additional separate deduction for any of these expenses.

Please use Table 2 as a reference for eligible home office expenses that you can claim additionally to the running expenses covered by 67 cents.

What do I need to do?

Firstly - Demonstrate that you are working from home

You must be working from home while carrying out your employment duties or while carrying on your business on or after 1 July 2022. The work has to be substantive and directly related to an income-producing activities.

*Please note, minimal tasks such as occasionally checking emails or taking phone calls while at home will not qualify as working from home.

Secondly – Show you have incurred deductible additional running expenses

You must incur additional running expenses listed in Table 2 which are deductible under s. 8-1 of the ITAA 1997 as a result of working from home.

You are not required to demonstrate that you have incurred additional running expenses as a result of working from home. This can be demonstrated by the number of hours you have worked from home.

Where a third party (e.g. an employer) reimburses you for the additional running expenses, you will fail this step.

Lastly – You must keep and retain relevant records for expenses incurred

1. Record keeping for home office hours.

From 1 July 2022 to 28 February 2023, you need to keep a record which is representative of the total number of hours worked from home during this period.

From 1 Mar 2023, you need to record the total number of actual hours worked from home in one of the following forms:

- Timesheets

- Rosters

- Logs of time the taxpayer spent accessing employer systems or online business systems

- Time-tracking apps

- A diary or similar document kept contemporaneously.

2. Record keeping for running expenses covered by rate per hour

You need to keep one document (e.g. an invoice, bill or credit card statement), for each of the listed running expenses (such as electricity and gas) that you have incurred during the income year.

For occasional expenses (such as stationery and computer consumables), you must keep one receipt for each item purchased.

3. Record keeping for decline in value of home office assets

You need to demonstrate the work-related use of the depreciating asset by keep records of a representative four-week period that show personal and income-producing use of the depreciating assets.

For more information on what is required from you under the new rules or to discuss any questions, please contact your trusted Nexia advisor.