Exposure draft: Proposed “look-through” approach for earnouts from 23 April 2015

What happened?

As you may be aware, many business owners use earnout arrangements when they sell their business and the value of the business (and therefore the sale / purchase price) cannot be accurately determined – a scenario very common when selling unlisted SME businesses that have substantial goodwill.

The conditional nature of earnout arrangements, whereby the holder of an earnout right1 would only be entitled to a payment

of extra money if certain economic performance thresholds (for example a certain amount of sales for a certain period of time after the sale of the business) are met2 or not met3, makes it a powerful tool for such business sales.

As you can see from the timeline below, the tax treatment of earnout rights has been an area of constant change for some time now.

Recently, the Government released draft legislation4 to change the tax treatment of certain eligible earnout rights (basically from the so-called “separate assets” approach to the “look-though” approach)5.

This means that for eligible earnouts entered into on or after 23 April 2015:

-

The capital gains and losses arising from eligible earnout rights will now no longer be recognised separately (as was the position under the separate assets approach); and

-

The financial benefits received under the earnout right will only affect the capital proceeds and cost base of the underlying asset to which the earnout arrangement relates (this is the look-through approach).

There are also transitional rules in place for earnout arrangements entered into before 23 April 2015.

What does this mean for you?

Overview of look-through approach

Under the look-through approach, only a provisional capital gain solely consisting of the fixed consideration received will be determined on the day of the sale (as the sale proceeds on that day will not include the value of the earnout rights).

However, each time an earnout right “crystallises” into a financial benefit (i.e. when the contingent economic performance thresholds of the earnout are met), an “updated” capital gain will have to be worked out (because the earnouts will affect the sale proceeds of the original transaction).

This means that the amount of the sale proceeds – and hence the accompanying capital gain - needs to be updated every year the earnout agreement is in existence6.

Although this look-through approach may seem tedious and require lots of rework (i.e. going back and amending previous years’ tax returns), it will:

-

defer the payment of the capital gain on the eligible7 earnout rights by disregarding the value of the earnout right when working out the capital proceeds from the sale transaction at the date of sale; and

-

treat a subsequent payment received by the seller because of the earnout right as part of the original capital proceeds – which may be subject to the small business CGT concessions.

Practical example of look-through approach

The practical example8 below illustrates this continual adjustment of the capital gain when dealing with standard earnouts:

Facts

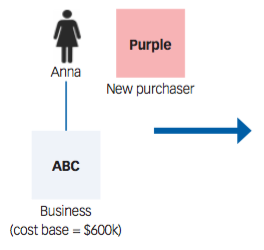

- Anna sells ABC to Purple in March 2016

- Sale arrangement:

-

$1m upfront

-

1st earnout = $100k in March 2017

-

2nd earnout = $100k in March 2018

Assuming the performance thresholds for the first earnout are met, but Purple pays $50k9 to end the arrangement before the 2nd earnout, the results will be as follows in the different years:

Year |

Anna’s 2016 capital gain will be amended to: |

|

2016: |

$400k |

|

2017: |

$500k (i.e. amend to increase by $100k) |

|

2018: |

$550k (i.e. amend to increase by $50k) |

Therefore, although Anna has sold the business in 2016, she would only be able to work out the final capital gain relating to the 2016 sale (of $550k and not $400k) in 2018. Anna would need to adjust her capital gain of $400k in her 2016 tax return to $500k in 2017 and subsequently to $550k in 2018.

Effectively this defers the tax due on the earnout rights to years following the sale (i.e. 2017 where the earnout right crystallises in a monetary benefit and 2018 when the earnout arrangement ends). This also means that:

-

$1.15m (and not $1m) will be the proceeds received by the seller Anna; and

- $1.15m (and not $1m) will be the cost base of the business for the new buyer Purple.

Transitional rules

Although the look-through amendments under this draft legislation do not apply to earnout arrangements entered into before 23 April 2015, earnout arrangements entered into between 11 May 2010 and 23 April 2015 that adopted a look-through approach based on the 2011 Budget announcement (in May 2010), may have their current income tax treatment preserved (i.e. the tax treatment based on a discussion paper released on 12 May 2010).

This means that say an earnout arrangement10 was entered into in February 2014 (i.e. before 23 April 2015) and based on the 12 May 2010 discussion paper, the taxpayer applied a look-through approach to the earnout (i.e. lodged the 2014 tax and subsequent 2015 tax return after 23 April 2015 but based on the law as was previously anticipated in the May 2010 discussion paper), the ATO will not be able to challenge this tax treatment.

How can Nexia help you?

If you are contemplating selling your business, or have recently sold your business through an earnout arrangement, it is important that the earnout rights are treated correctly for tax purposes - especially because these draft rules have implications for both future and past arrangements.

We would be happy to perform a financial health check (and scrutinise how earnouts were treated) if you have recently sold your business.

Furthermore, if you are contemplating selling your business, with our Corporate Advisory team we can assist you with the sale process from valuation through to structuring to maximise the after tax return you receive for your asset and to ensure the earnout rights are eligible11 for look-through treatment.

Nexia Australia has the necessary skill and experience to help you through all the steps involved when selling a business.

Please contact your Nexia Advisor if you want to know more about earnout rights and how these proposals may affect you.

Correspondingly, since the draft legislation may change, if you are affected by these proposals, we would be pleased to hear your views on this issue.

1- Basically a conditional right to a financial benefit based on the economic performance of the business.

2- Pursuant to a standard earnout right, a seller will receive more proceeds if certain performance thresholds are met (which will lead to a higher capital gain for the seller of the business).

3 - Pursuant to a reverse earnout right, a buyer will receive a repayment of proceeds that the buyer had originally paid to the seller if certain performance thresholds are not met (which will lead to a lower capital gain for the seller of the business).

4 - Exposure Draft: Providing “look-through” CGT treatment to earnout arrangements”, 23 April 2015

5 - Such a look-through approach was already contemplated by the previous Government in

the 2010-11 Budget announcements. However, the April 2015 is the first follow up from this announcement.

6 - Capital losses arising from a CGT event related to an earnout right may not be taken into account in determining tax liabilities until such time as they cannot be reduced by future financial benefits received under a relevant look-through earnout right.

7 - An earnout right will be eligible for “look-through” treatment if there was a disposal of the business or its business assets (i.e. active asset), the earnout was contingent on the future economic performance of the asset that was sold, the earnout arrangement was for a maximum of 4 years and the earnout right was created on arm’s length terms.

8 - Adapted from Example 1.5 in the Explanatory Memorandum accompanying the Exposure Draft.

9 - A payment to end an earnout right (i.e. $50k in this case), is treated in the same way as a financial benefit provided under the earnout right.

10 - Adapted from Example 1.8 in the Explanatory Memorandum accompanying the Exposure Draft.

11 - See footnote 7 above about when earnouts will be eligible for look-through treatment.