Did you know you may be entitled to a R&D tax incentive?

This alert is relevant for you if you are conducting innovative activities (e.g. in manufacturing or software development). Let Nexia Australia assist you to determine whether you may qualify for the R&D incentive – and then help you claim it.

You may be eligible for a tax offset

R&D relief is provided in Australia through a tax based incentive program whereby the Australian Government provides companies with a cash rebate or tax offset (as opposed to a tax deduction) if they conduct eligible R&D activities (and spend at least $20,000 on such R&D activities).

The incentive is generally only available for R&D activities conducted in Australia, but in certain circumstances, R&D activities conducted outside Australia may qualify if the overseas activities have a significant scientific link to core R&D activities conducted in Australia and are not able to be conducted in Australia.

How much is the tax offset?

Did you spend at least $20,000 on R&D?

For the 2016 income tax year

-

45% refundable offset if turnover < $20 million

-

40% non-refundable offset if turnover ≥ $20 million

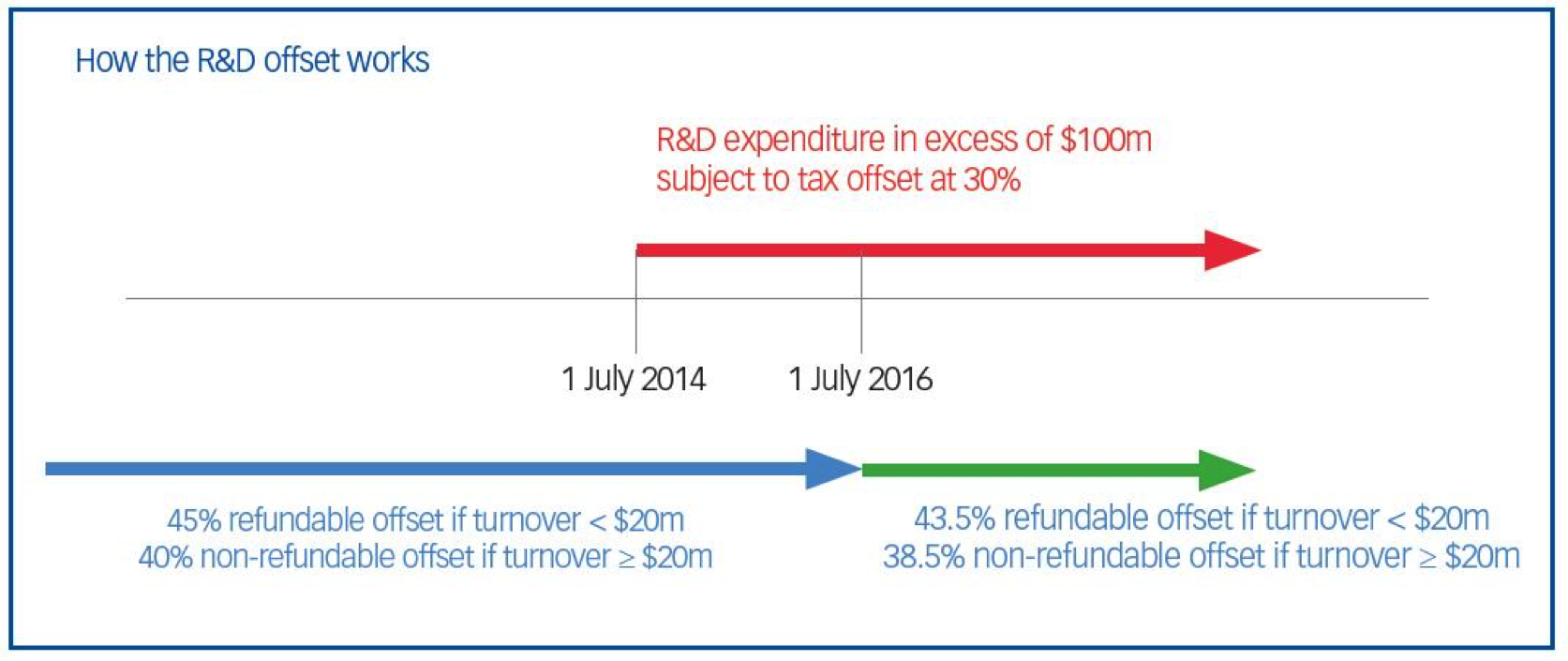

A set out in the diagram below, the size and the nature of the offset depend upon the company’s turnover and the amount of R&D expenditure incurred by the company.

The 45% refundable offset available to smaller companies can therefore provide cash injection to help start-ups that are often cash-strapped. For example, a start-up company that is in a loss position for tax purposes that spends $1 million on R&D will receive a $450,000 cash refund under this incentive in the 2016 income tax year. However, if this were to occur in the 2017 income tax year, the amount of such an incentive will only be worth $435,000 (because the R&D offset rate will be lowered by 1.5% for income years starting on or after 1 July 2016)1.

What are eligible R&D activities?

- Core R&D activities (broadly systematic experimental activities conducted for the purpose of generating new knowledge); or

- Supporting R&D activities (broadly activities that relate to the core R&D activities).

Companies should meticulously document how they are conducting their R&D activities as well as keep records of their observations, evaluations and conclusions resulting from these activities.

Some examples of activities that are NOT core R&D activities (but may be supporting R&D activities) include:

- Reverse engineering or developing computer software for internal administration;

- Market research, management studies or research in humanities, social sciences or arts; or

- Mineral exploration or activities to comply with statutory requirements or standards.

How can Nexia Australia help you?

-

Proven experience with R&D claims

-

Lodge registration by 30 April 2017

Nexia Australia has the necessary skills and experience to assist you with all of your R&D claims and record-keeping requirements to ensure your company has the best chance of qualifying for this valuable incentive.

We can assess the eligibility of a company’s business and projects (e.g. determine whether their activities are core or supporting R&D activities) and register the R&D activities with AusIndustry by 30 April 2017 (for companies with income years ending 30 June 2016) so that when the company lodges its company tax return and R&D schedule (and quoting the registration number), the correct tax offset/refund may be claimed from the ATO.

Checking with us whether any of your activities may qualify for the R&D offset could be financially rewarding.

Please contact your local Nexia Specialist if you would like to discuss how any of the issues mentioned above may affect your company so that we can identify R&D risks and opportunities for you.

1 - Budget Savings (Omnibus) Act 2016 – received Royal Assent on 16 September 2016.