Many business owners roll their eyes at the mention of Fringe Benefits Tax (FBT). Complex rules, costly to comply with, and for seemingly little value. But even if you don’t pay any FBT, it still plays a role in your business. So, to truly understand why FBT affects your business – even if you don’t pay any – let’s help you “get it”.

Once upon a time, there was a hole…

Before FBT was introduced, the cost of a benefit provided to a specific employee was generally deductible for the business, and the employee was supposed to declare that amount as income on their tax return and pay income tax – yes, that was the law. However, pretty much no one declared the amount in their tax return, and the ATO pretty much didn’t enforce that law. Accordingly, businesses provided lots of “tax-free” benefits to employees as part of their remuneration. This left a sizeable hole in the tax system that needed to be plugged.

FBT was thus introduced, pegged to the top personal tax rate plus Medicare Levy (currently 47%), but made politically palatable by nominally placing the tax burden on employers. Combined with complementary changes introduced at the same time, FBT perhaps has its greatest impact, not through the revenue it raises, but by altering business behaviour. The reason is that FBT is not just a business cost – its mere prospect influences decisions. Entertainment and cars have always been FBT’s main targets, and since its introduction, the “long lunch” was never quite the same again, and company car perks became less perky.

Employee remuneration

FBT also influences decisions concerning employee remuneration and incentivising key staff. When it comes to properly managing remuneration, whatever the make-up of the components, the total employment cost for the employer should be the agreed amount of remuneration. However, outcomes can differ for the employee, and that’s where remuneration planning comes in – maximising the value for the employee.

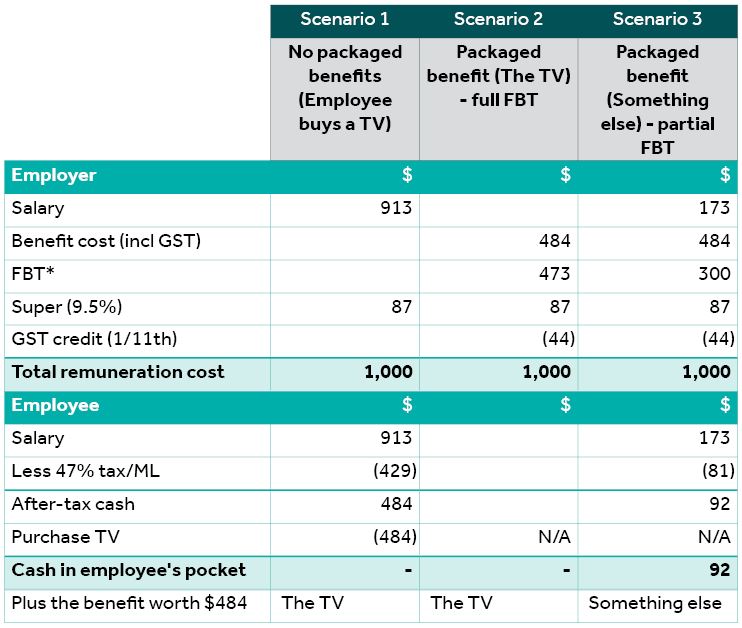

Let’s take $1,000 of remuneration, and show how the cost to the employer remains the same (as it should), while differing outcomes can arise for the employee when that $1,000 is replaced with a packaged fringe benefit.

Scenario 1 below is the simple situation with no packaged benefits, and so it is simply salary plus the compulsory 9.5% superannuation, totalling to $1,000. The employee, whom let’s say is on the top tax rate, receives $484 after tax, then goes out and buys a small TV costing that amount (incl GST). This is our basis of comparison for when the $1,000 of remuneration is replaced with a packaged fringe benefit.

In Scenario 2, the $1,000 is replaced to the greatest extent possible with a fringe benefit subject to full FBT. A recent change in the law requires the 9.5% compulsory superannuation to be maintained on the sacrificed salary. The amount of the benefit needs to be whatever amount such that it, plus FBT arising, plus the superannuation, less any GST credit in the cost of providing the benefit, totals to $1,000. Interestingly, that turns out to be $484. So, let’s say that TV is the packaged benefit.

Let’s think about the outcomes. Scenarios 1 and 2 both leave the employee with the TV and no cash. Further, in Scenario 1, the government collects $429 of income tax, and in Scenario 2, they collect $473 of FBT, less the $44 GST credit, which nets to the same $429. So, compared to Scenario 1, packaging that TV in Scenario 2 makes no difference to the employee, no difference to the employer (except the additional administrative costs), and no difference in tax collected. That outcome is by design – packaging a fully taxed fringe benefit for an employee on the top personal tax rate achieves… nothing.

Hole, meet plug.

Incidentally, if you did the same packaging exercise for an employee on a lower tax rate, the tax collected in Scenario 2 will be higher, and the employee will end up in a worse position.

Packaging for key employees

Okay, so what is the point of salary packaging? How exactly can it help to incentivise and retain key employees? Well, some fringe benefits aren’t fully taxed. That comes about in two ways: 1) the benefit itself is not fully taxed, irrespective of the employer, and 2) the employer is a specific kind, with a concessional FBT impost (eg, aged care provider). In these circumstances, the FBT is less than the full amount per Scenario 2, and so there is space left for some remaining salary such that the employer’s remuneration cost still totals to $1,000.

And that brings us to Scenario 3, where the benefit provided triggers less than full FBT. In Scenario 2, the employee needs to sacrifice $913 of salary to get the $484 TV. However, to get the different benefit (of equal value) in Scenario 3, they need only sacrifice $740, leaving them with $173 of salary. The result is that they get that benefit worth $484, and still have some after-tax cash in their pocket.

So, what fringe benefits don’t trigger full FBT? Although there are others, the typical one, funnily enough, is cars. Even though the way FBT is applied to cars was tightened a few years ago, there is still scope to package them effectively for high-income key employees, especially through what’s called a novated lease.

Looking ahead

With the 31 March FBT year-end nearing, there is probably not much you can do for this year. But as a new FBT year dawns, think about the packaging/FBT possibilities for your key staff. It’s so much easier when you “get it”.

Talk to your trusted Nexia advisor about remuneration packaging, and how we can help you incentivise and retain key employees in your business.

*Scenario 2: $484 x 2.0802 [Type 1 gross-up rate] x 47% = $473. Scenario 3: Illustrative amount of FBT.