Financial markets can be highly reactive to unexpected events. It’s often said that the markets love certainty – investors feel more confident when economic conditions are stable and predictable.

However, certainty in financial conditions is never a sure thing. Uncertainty is always just around the corner with the possibility of changes in interest rates, new laws or regulations, disturbances in overseas markets, a breakdown in Australia’s relationship with a major trading partner, wars and political instability.

As a result, stability and predictability are most often brief, with changes in prices inevitable.

Between 2020 and 2022, we were dealing with the side effects of COVID-19 on the economy and markets. Since 2022, interest rates have risen, and increases in the cost of living and conflicts in Ukraine and the Middle East have caused further market instability.

This year, global political stability may be affecting markets with almost 50% of the world’s population due to head to the polls to choose new governments including the United States, India, Russia, South Korea and the European Union. Interest rate movements in Australia and overseas are another focus.

In this dynamic environment, investors find themselves grappling with crucial decisions about safeguarding and optimising their portfolios.

It could be useful to know that making quick decisions and reacting quickly to the latest event may not be the best move.

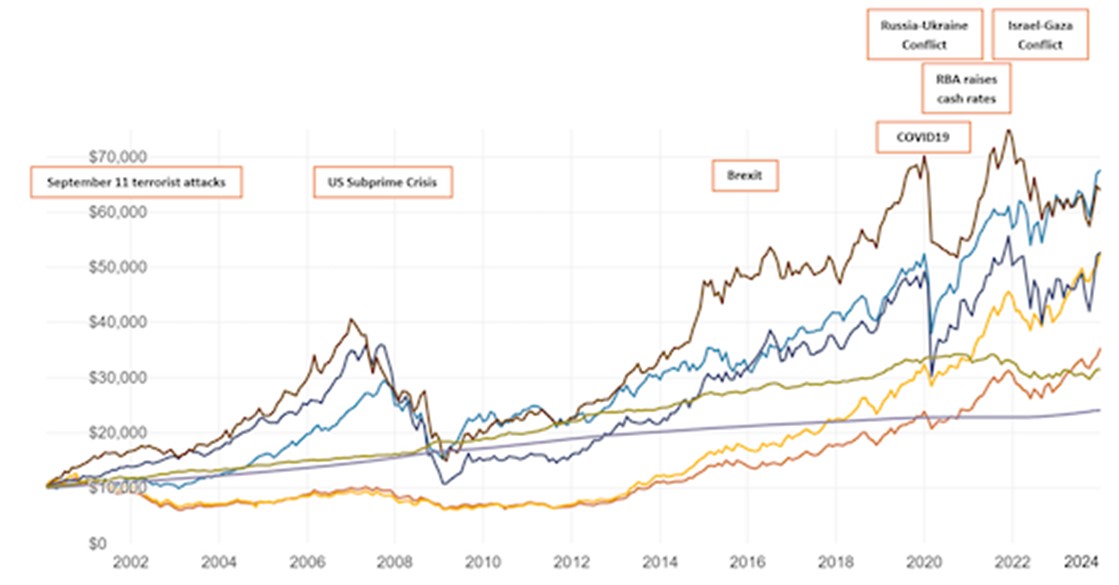

Consider the performance of various asset classes over 24 years. If you had invested $10,000 in a basket of Australian shares on 1 February 2000, for example, your portfolio would have been worth $67,717 at 31 January 2024, delivering a return of 8.3% each year. The same amount invested in international shares over the period would have provided a 5.4% annual return with your portfolio then at $35,373.

US investment advisers Dimensional have calculated the risk to a portfolio of being out of the market for even a short period.

In other words, reacting to events by quickly selling up can have an undesirable effect on your portfolio.

Market uncertainty caused by key historical events

Source: Vanguard Digital Index Chart

Missed opportunity

Source: Dimension Funds Advisors

Long term investing

It is almost impossible to time the market by identifying the best and worst days to buy and sell. Some investors prefer to invest in a well-diversified portfolio for the long term.

Historically, long-term investors who have weathered short-term storms have been rewarded. Markets have shown they tend to recover over time, and a diversified portfolio allows investors to capture the upside when conditions improve.

This provides a bonus – the compounding effect of returns over an extended period can significantly enhance the overall performance of a portfolio if they are reinvested.

Why diversify?

Different asset classes – such as shares, bonds and cash – perform differently at different times.

By diversifying investments across different asset classes, regions and companies can work towards reducing the effect of a poorly performing asset on the overall portfolio, providing a buffer against volatility and lowering risk.

Next steps

Appreciating the lessons learned from the past while also understanding that past performance may not predict future performance is a helpful way of navigating the uncertainties of the global markets.

Our team of experts can help you achieve a strong investment strategy, design a portfolio that meets your objectives, and navigate the complexities of the markets so you can connect with your true potential and achieve your investment goals