AFSL Compliance – A General Overview

Australian financial services (AFS) licensees have a general obligation to provide efficient, honest, and fair financial services and must comply with the conditions of the AFS licence and the Corporations Act 2001.

Recently, we have seen an increase in ASIC’s ongoing efforts to improve standards across the financial services industry. There have been many media releases by the regulator because of suspension or cancelation of AFSLs not complying with licence conditions or the Corporations Act 2001. Some AFSL holders incurred heavy fines from the regulator.

Under the Corporations Act 2001, ASIC may suspend or cancel an AFS licence if the licensee is no longer providing financial services or fails to meet its key obligations, as detailed in ASIC’s regulatory guidance.

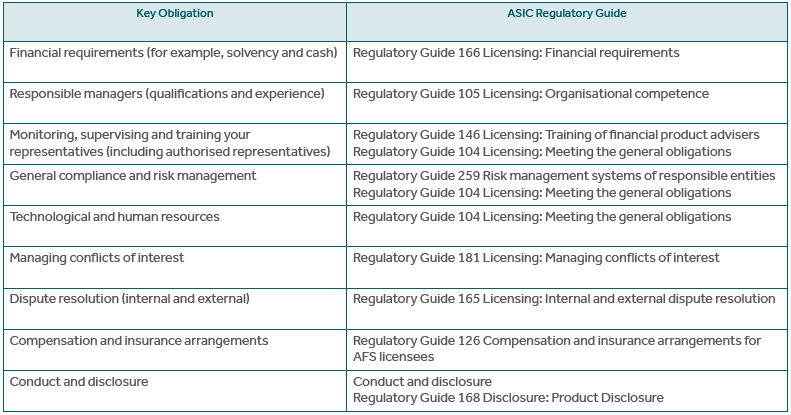

Key obligations and guidance are set out below:

Some aspects of the key obligations and guidance for AFSL holders are summarised below:

1. Financial requirements – base level

(a) The solvency and positive net assets requirement

At all times you must be solvent (i.e., be able to pay all your debts as and when they become due and payable) and have total assets that exceed total liabilities (as shown in your most recent annual balance sheet lodged with ASIC), and always have no reason to suspect that total assets would no longer exceed total liabilities on a current balance sheet.

Note: If you have more liabilities than assets, you can apply an alternative test. You can calculate based on adjusted assets and adjusted liabilities as defined in the guide.

(b) The cash needs requirement

You must have sufficient resources to meet your anticipated cash flow expenses.

(c) The audit requirement

You must include information about your compliance with the financial requirements in your audit report under s989B(3).

2. Responsible Managers

Australian financial services (AFS) licensees must comply with the organisational competence obligation in s912A(1)(e) of the Corporations Act 2001 (Corporations Act), and AFS licence applicants must be able to demonstrate in their licence application that they can comply with this obligation as set out in the guidelines.

What you need to do to comply will depend on the nature, scale and complexity of your business however the guidance sets out minimum expectations for demonstrating organisational competence.

At a minimum, you need to nominate responsible managers who are directly responsible for significant day-to-day decisions about the ongoing provision of your financial services, have appropriate knowledge and skills for all your financial services and products and individually, meet one of the five options for demonstrating appropriate knowledge and skills. You also need to have measures in place to ensure that you always maintain your organisational competence.

3. Other obligations

For all the obligations it is expected that AFSL holders document measures in an acceptable form, fully implement, monitor, and report on their use and regularly review the effectiveness of the measures and ensure they are up to date in accordance with the guidelines.

Once these measures are documented AFSL holders need to implement and integrate them in the daily operations of the business. All people need to understand them and be committed to their success. Licence holders will also need to monitor and report on their compliance, including reporting relevant breaches to ASIC under s912D.

Where some functions are outsourced it is expected that AFSL holders will choose suitable independent service providers and monitor and document their ongoing performance. Licence holders will need to deal appropriately with any service providers that breach service levels agreements or licence holder obligations.

The audit and review on compliance

The Corporations Act 2001 imposes audit and review requirements on the Australian Financial Service (AFS) licence holders. In particular s989B(3) of the Corporations Act 2001 requires a licensee to lodge an auditor’s report containing the information and matters required by Corporations Regulation 7.8.13 at the same time as lodging its annual financial statements. ASIC have prescribed a form for this auditor’s report – Form FS71 – which defines the scope and format of the auditor’s report

Some of the information or explanations you may need to provide to your auditor can include the following depending on the size and nature of your operation.

- Provide an understanding of the internal controls in place to ensure compliance with licence conditions and Corporations act requirements which should include breach and complaints registers

- Documented procedures for identifying and updating your AFSL obligations

- Details of staff training and awareness programs together with management review

- Procedures for assessing the impact to licensees’ obligations on the entity’s key business activities which may include risk management questionnaires

- Controls embedded within key business processes designed to ensure compliance with AFSL obligations

- A monitoring plan to test key compliance controls on a periodic basis and report exceptions which will include cash flows and cash balances, internal file reviews, financial ratios

- Procedures for identifying, assessing, rectifying, and reporting compliance incidents and breaches

- Periodic sign off by management as to compliance with obligations

- A compliance governance structure establishing responsibility for the oversight of compliance control activities with those charged with governance e.g., Audit, risk, or compliance sub-committees

Given the increased focus on compliance and back office operations over the last few years AFSL holders need to be diligent in complying with their ongoing AFSL obligations or risk suspension or cancelation of their licences in addition to other punitive measures that can be implemented by the regulator.

Please contact your local Nexia Advisor if you need any assistance or have queries re your obligations concerning your AFSL.