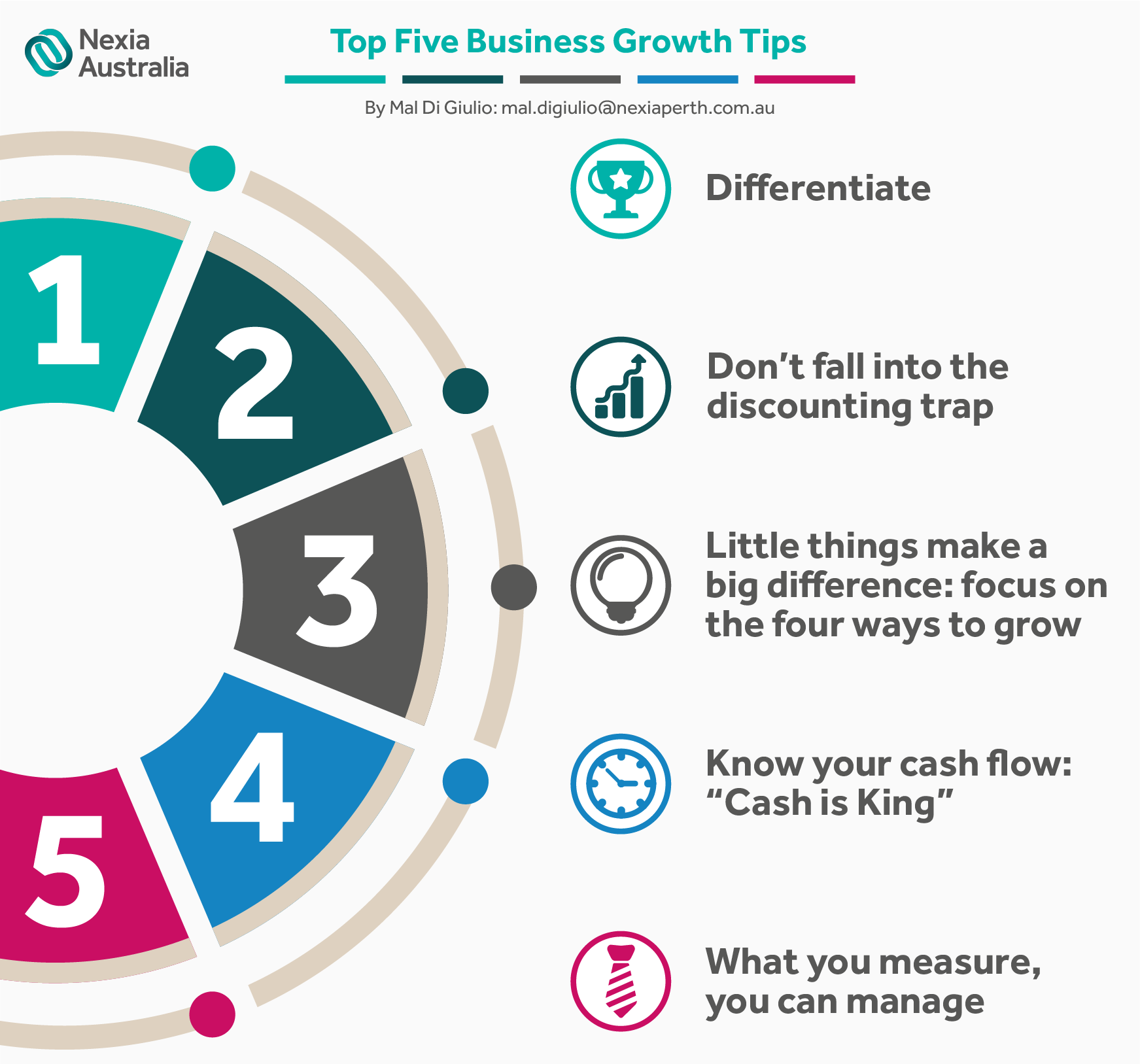

In today’s hyper-competitive environment, if you’re not moving forwards then you’re moving backwards. Business growth is bridge to a bigger, better and brighter future yet often, its management is left lacking. In this article, I dissect and discuss five key items that must be addressed to ensure you’re enacting a personalised and well-considered business growth plan.

Differentiate

If your business intends on being all things to all people, you’re in for a rude awakening. It’s unlikely an organisation structured to compete on cost will resemble a business configured to cultivate relationships. If you’re not in command of the lowest cost infrastructure, what to do? You differentiate.

Differentiation is about creating value for customers, servicing critical success factors and marketing a compelling narrative designed to stimulate unique feature purchase decision-making. These aspects combine to form your unique selling proposition.

Give your customers reasons not to buy on price.

Don’t fall into the discounting trap

Crash your price, sell more and profits skyrocket, right? Wrong! On a gross profit of 30 per cent, to meet the status quo, a price reduction of just 10 per cent requires 50 per cent more sales. Conversely, on a gross profit of 30 per cent with a 10 per cent price hike, an organisation can afford to lose 25 per cent of current volume and still find itself in front. Which scenario seems more palatable?

Perception informs. Don’t provide your customers an opportunity to perceive and reclassify your product as lower value, become accustomed to periodic discounting and infer a lack of confidence, instead, put your unique selling proposition to work and when appropriate, raise your price.

Little things make a big difference: focus on the four ways to grow

Time and time again, sports stars talk about focusing on the little things. In business, it’s no different. The commitment and resolve to focus on what’s immediately in front of you and in your control is paramount. When concerning growth, there are four available options: (1) increase the number of clients, (2) shorten the buying cycle, (3) increase the average sale value and (4) systematise and create efficiencies.

- Increase the number of clients – attract clients through attrition and acquisition strategies

- Shorten the buying cycle – consider measures you can take to improve purchase frequency

- Increase the average sale value – “do you want fries and coke with that?” approach

- Systematise and create efficiencies – minimise time and cost constraints

Know your cash flow: “Cash is King”

The great irony of success is a rapidly expanding business may in fact, send you broke. To achieve sustainable growth, understanding the relationship between profit and cash, cash flow and your bank account and working capital cannot be understated.

The most important document in your financial arsenal is the cash flow statement. It’s unwise to solely rely on a profit and loss statement or balance sheet as a cash flow statement articulates your operating, investing and financing activities. That is, it outlines cash receipts, cash expenditures and informs your organisation’s financial cycle.

Come budget time, a well-considered financial argument will cite profit and loss, balance sheet and cash flow statements.

What you can measure, you can manage

Financial reporting should tell a story. Consider key performance indicators. A KPI allows an organisation to track a measurable value against a set objective. Without performance measurements, how does an organisation expect to understand if enacted strategies are effectual?

Once you commit to measurement, it’s vitally important information is received in a timely manner. For instance, a profit and loss statement is a lag indicator. For immediate performance feedback, consider cloud accounting. The real-time cloud environment should help you readily identify trends but also, adapt on-the-fly.

Inform decision-making with high quality, tailored and up-to-date information from the cloud.

Running a small-medium enterprise business is more than a commitment, it’s a bridge to a bigger, better and brighter future. That’s why we offer a suite of services and designed a program to assess and assist small-medium enterprise businesses. Say hello to Cash Growth Value. At Nexia, we’d welcome the opportunity to show you how this program will enhance and enrich your business experience.

To see how Cash Growth Value works, contact Mal today.