This guide only covers real estate purchase transactions, however please note that this 10% withholding rule is not just limited to the purchase of real estate – this 10% withholding rule can also apply to other types of property transactions - download our comprehensive guide for more information. Furthermore, this rule has potential application to all acquisitions3 - whether effected through a purchase, a transfer of relevant property via gifts, divorce proceedings or other distributions (e.g. in specie property distributions from trusts or from deceased estates).

10% withholding shake-up if you buy real estate

What happened?

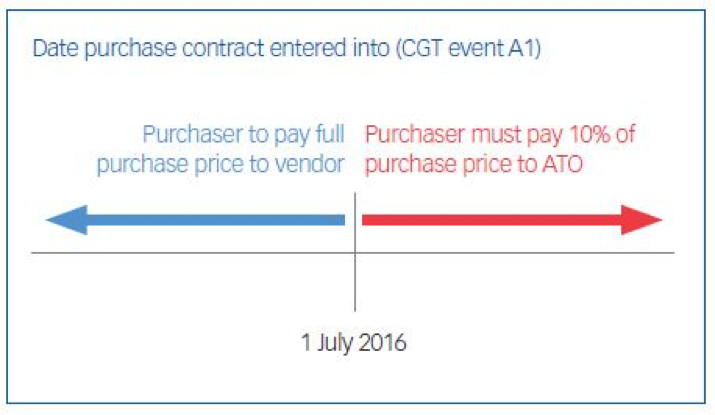

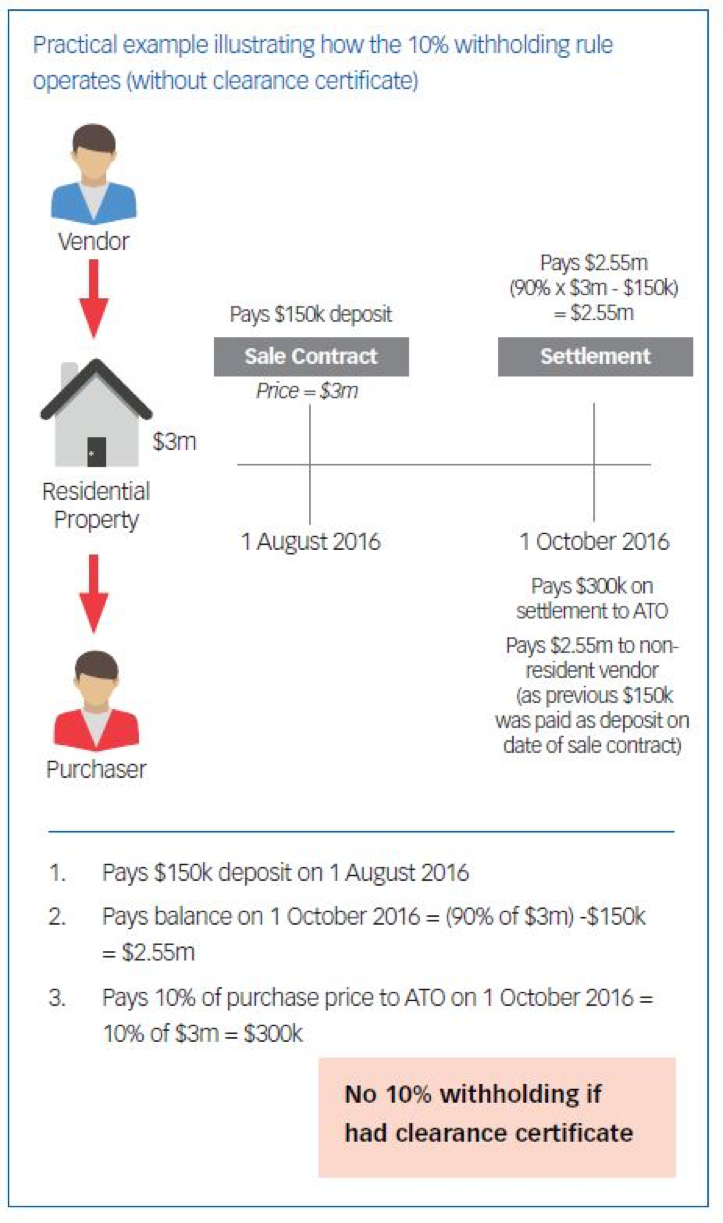

From 1 July 2016, all purchasers of real estate in Australia (whether purchased from a resident or foreign resident vendor) must withhold 10% of the purchase price, unless the transaction is excluded from these rules or the parties undertake certain actions before settlement date.

The principal rule is that a purchaser will:

- pay 10% of the property’s purchase price to the ATO (on or before settlement) to serve as a prepayment of the foreign resident vendor’s tax liability (that will be set-off against the vendor’s tax liability calculated when the vendor lodges a tax return); and

- only pay the foreign resident vendor 90% of the purchase price (i.e. 10% of funds are withheld from their sale proceeds).

The 10% withholding tax is paid by the purchaser as part of the purchase price and not in addition to the purchase price and the purchaser does not have any liability to pay the vendor to the extent that an amount has been paid to the ATO as required by this withholding obligation1 .

Although one of the main aims of this 10% withholding rule is to ensure that more foreign residents lodge their Australian tax returns, unfortunately this 10% withholding rule can potentially also apply to property purchases from resident vendors2.

What does this mean for you?

What can you do to prevent this rule from applying?

If you enter into a contract to purchase real estate on or after 1 July 2016, you can potentially be subject to this 10% withholding rule unless:

- Certain exemptions apply – e.g. if the arm’s length purchase price of the property is less than $2 million; or

- The vendor applies to the ATO for a clearance certificate and provides the certificate to the purchaser before settlement date.

1. No 10% withholding if market value of real property is less than $2 million

If the $2 million market value exception applies, there is no need to obtain a clearance certificate

In particular, there is a specific carve out for real estate with a market value of less than $2 million – this means a purchaser of lower valued real estate will not have to withhold 10% of the purchase price.

For arm’s length sale of real estate transactions, the market value would usually be the purchase price4 / first element of the CGT cost base (excluding stamp duty and legal costs since market value is determined at date of signing the contract). Furthermore, GST would be excluded if the purchaser is not registered for GST but included if the purchaser is registered for GST.

For non-arm’s length transactions the market value substitution rule will apply to require the purchaser to establish the correct market value of the real property at the date of acquisition5 .

Examples of assets that can qualify for the $2 million exclusion include:

- Residential premises

- Commercial property

- Vacant land

- Easements

- Covenants

- Mortgages

- Strata title schemes

- Company title interests (a type of interest that confers the holder of a share to occupy the real property that the company owns)

Multiple purchasers will only qualify for this exclusion if the sum of the market value of all their respective interests is less than $2 million. Conversely, this means that if the aggregated purchase price is $2 million or more, each purchaser must withhold tax in proportion to their percentage of the total purchase price.

How does the $2m exclusion operate if real estate is purchased using an option contract?

No $2m exclusion on grant or transfer of option6

Where a purchaser buys real estate from a relevant foreign resident using an option contract, the purchaser must pay the ATO 10% of the option fee on or before the option is granted or transferred (i.e. when the purchaser becomes the owner) – even if the real estate has a market value of less than $2 million (i.e. no $2 million exclusion on the grant or transfer of an option).

$2m exclusion on exercise of option7

However, where real estate is acquired through the exercise of an option, and the real estate has a market value of less than $2 million, no 10% withholding is payable on exercise of the option (i.e. $2 million exclusion applies on exercise of option).

Note that if the market value of the real estate is $2 million or more, 10% withholding is payable on the exercise of the option. However, to prevent double counting where an option has been granted and exercised, the 10% withholding obligation will be calculated on the difference between the aggregate of the purchase price and the option fee paid less the option fee8.

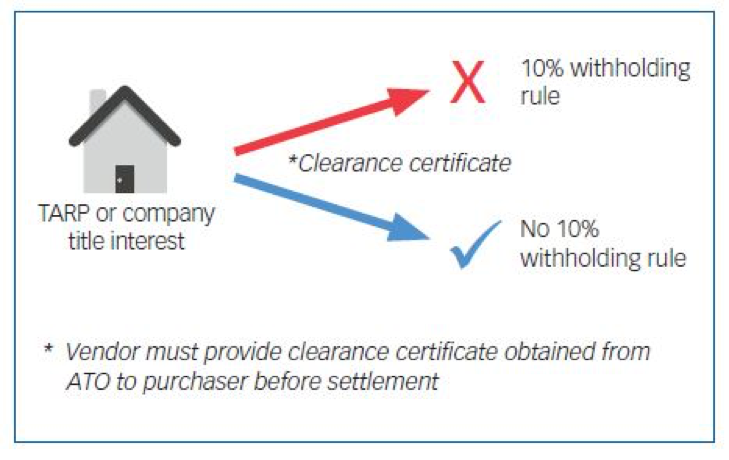

2. No 10% withholding if vendor has clearance certificate

If the $2 million exclusion does not apply, resident vendor must obtain and provide an ATO clearance certificate to purchaser before settlement

A purchaser who purchases real estate costing $2 million or more will automatically9 be subject to the 10% withholding rule unless the vendor provides the purchaser with a valid ATO clearance certificate before settlement of the transaction.

The ATO will only issue a clearance certificate if - based on available information - there is nothing to suggest that the vendor will be a relevant foreign resident10 (this means only resident vendors can be granted clearance certificates).

Since the vendor11 needs to apply for the clearance certificate (i.e. the ATO does not issue such certificates automatically), this necessarily means that if a resident vendor does not apply or obtain a clearance certificate or does not provide such a certificate to the purchaser before settlement date, such a purchaser will be subject to the 10% withholding rule (i.e. because such a resident vendor will be deemed a relevant foreign resident for the 10% withholding rule purposes only).

If more than one vendor is involved, each vendor must apply separately for a clearance certificate and if any of the vendors fails to provide such a clearance certificate to the purchaser – then, absent a variation - the purchaser must withhold 10% of the purchase price (in proportion to each vendor’s interest in the property)12.

Having a clearance certificate does not automatically mean that a vendor taxpayer will be a resident for all tax purposes. A certificate only means that the purchaser is not required to withhold an amount from the purchase price.

3. Compliance impact of this measure

This 10% withholding obligation will inevitably lead to added compliance costs for both the purchaser and vendor of real property.

In particular, sale contracts may need to be updated to insert clauses where the obtaining of a clearance certificate by the vendor (and ultimately providing the certificate to the purchaser before settlement) will be a condition precedent for the sale to proceed. Furthermore, a purchaser paying the 10% tax to the ATO must register as a withholder13 and if the purchaser fails to pay over the 10% to the ATO, the purchaser will be liable to pay (as a penalty to the ATO) an amount equal to the 10% that was not withheld14.

How can Nexia help you?

Important that purchaser and vendor communicate with each other about these issues so that they can be resolved prior to signing the contract

This new legislation places an inescapable compliance burden on parties involved in selling property in Australia and will affect real estate agents and conveyancing lawyers.

This means, for all real estate transactions from 1 July 2016, the parties should consider the following issues set out in the table below:

Scenario when selling real estate |

Action required to avoid 10% withholding rule |

|

| 1 | Purchase price < $2 million (resident / foreign vendor) | No action required because $2 million exemption |

| 2 | Purchase price ≥ $2 million (resident vendor) | Vendor required to apply for a clearance certificate and deliver to the purchaser before settlement |

| 3 | Purchase price ≥ $2 million (foreign vendor) | 10% withholding rule unless variation before settlement |

Please contact your Nexia Advisor if you are thinking of buying real estate and know or suspect that the vendor is a non-resident or has a foreign connection.

Also, even if you are a resident vendor, we can help you to obtain a clearance certificates so that the 10% withholding rule will not apply to you.

1 - s16-20(2) of the Taxation Administration Act 1953 (TAA 1953). 2 - This is because even a resident vendor can be a “relevant foreign resident” (i.e. a certain type of resident that can be subject to the 10% withholding rule) if a clearance certificate is not obtained by settlement date. 3 - s14-200(1)(a) of the TAA 1953. 4 - Paragraph 10 of LCG 2016/6. 5 -The ATO does not prescribe who may undertake a market valuation, but a valuation must be reliable and use an appropriate valuation methodology (Paragraph 15 of LCG 2016/6). 6 - Paragraphs 8-12 of LCG 2016/7. 7 - Paragraphs 13-17 of LCG 2016/7. 8 - Regardless of whether 10% withholding on the option fee was paid when the option was originally granted (e.g. no withholding may have been paid since the vendor gave a residency declaration that the purchaser does not believe to be untrue). 9 - Regardless of whether the purchaser knows or believes the purchaser to be a foreign resident. 10 - s14-210(1) of the TAA 1953 . 11 - Because the entity that has legal title to the asset, is the entity required to obtain the clearance certificate, a trustee holding a property on behalf of a trust or superannuation fund is the relevant entity that should apply for the clearance certificate (as opposed to the trust or superannuation fund). 12 - Legislative Instrument, PAYG withholding variation for foreign resident capital gains withholding payments – acquisitions from multiple entities, 30 June 2016. 13 - Section 16-140 of the TAA 1953 . 14 - Section 16-30 of the TAA 1953.