The Stage 3 tax cuts that take effect from 1 July 2024 seem to be the tax world’s Barbenheimer – widely anticipated with much fanfare, whilst also sparking some different opinions.

On one hand, it has been argued that they’re not really a tax cut, because they merely hand back tax increases over prior years through bracket creep. On the other hand, they were legislated before the government accumulated a large amount of debt to save the economy during the pandemic, and the forgone tax revenue would now come in handy to lighten that debt.

It could be said that the focus on the Stage 3 tax cuts is misplaced, as it only addresses an element of the larger problem – which is the lack of comprehensive tax reform.

In any case, after maintaining a position of no changes, the government has now announced that they will modify the legislated Stage 3 tax cuts. So, as the tax scales are still changing from 1 July, the question remains as to whether there is an opportunity to take advantage of the changes.

1 July changes

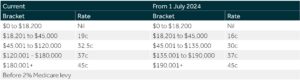

Here are the current tax scales and the modified Stage 3 changes in a few short months:

Adding to the Stages 1 and 2 tax changes a few years ago, the tax rate for the $18,201–$45,000 bracket will fall from 19c to 16c. The new 30c bracket will now extend to only $135,000, and the 37c bracket will be retained. The 45c rate will now apply from $190,001. Of course, these rates are before adding the 2c Medicare levy.

The modified changes are subject to being passed by Parliament.

The tax savings from the cuts themselves require no action on your part. The issue then is whether you can achieve a bonus tax saving by smartly navigating the changes in rates and thresholds.

Factors in achieving a bonus tax saving

You should undertake any tax planning like you would normally. What we are talking about here is a one-off taking of action that will achieve a bonus tax saving on top of the tax cuts themselves. The following 2 factors will determine whether the modified Stage 3 tax cuts could provide such an opportunity for you:

- Income level: Your expected taxable income (before taking any action) for the 2 income years straddling the change: 2023-24 (ie, the current year) and 2024-25; and

- Ability to defer taxable income: Are you able to shift taxable income from the current year and defer it to 2024-25? (There’s no advantage in shifting taxable income the other way.)

Factor 1 – Income level

The key point here is whether the rate of tax applying to a particular income level in the current year will decrease in 2024-25. For example, if, no matter what you do, your taxable income in both years will exceed $190,000, anything you do will happen within the 45c bracket across both years anyway. Therefore, there’s nothing for you to do except sit back and let the changes in rates and thresholds do all the work.

The retention of the 37c bracket will leave a smaller income range within which the applicable tax rate will decrease. It’s mainly the $45,001–$135,000 range (37c/32.5c down to 30c) and the $18,201–$45,000 range (19c down to 16c).

Factor 2 – Ability to defer taxable income

Broadly, are you able to take some action that will delay or shift taxable income from the current year to 2024-25? Common examples include making an intended deductible donation this year instead of next year, making a catch-up deductible superannuation contribution, prepaying a deductible expense this year (but which won’t then be a deduction in 2024-25), and legitimately delaying deriving income.

Below is a simple example of deciding when to make a deductible donation. The calculated tax outcomes use the rates in the above table for ease of reference, ignoring the 2c Medicare levy. As the Medicare levy would apply equally, the difference in the calculated tax amounts is what matters, not the absolute amounts themselves.

Example – Deductible donation

Ken expects his taxable income will be $190,000 in both the current 2023-24 year and in 2024-25. He has set aside $10,000 to make a one-off gift as a deductible donation. If he makes the donation by 30 June 2024, he will save $4,500 in tax. If he makes it after 30 June 2024, his tax saving will be only $3,700. The $800 shortfall simply reflects the 8c reduction in the applicable tax rate (45c vs 37c) applied to the $10,000 deduction.

Therefore, Ken should make the donation by 30 June 2024, and ensure that he has a receipt as evidence. Compared to making it after 30 June, he’ll have an extra $800 in his pocket.

It is apparent that the savings opportunities are modest. That’s because the 45c-to-37c decrease in tax rate applies to a narrow $10,000 income range. Although the 32.5c-to-30c decrease applies across a wider income range, the marginal 2.5c tax saving is relatively small. Further, you must weigh up any tax saving against things like any implementation costs (fees, advice, etc) and your personal time dealing with the people and the paperwork.

Next steps

Having turned our minds to the subject, we have discovered that the range of circumstances where a worthwhile permanent bonus tax saving will arise from legitimately shifting taxable income from 2023-24 to 2024-25 is perhaps quite narrow. Outside of those circumstances, the only thing for you to do is just sit back and accept the tax savings from the modified Stage 3 tax cuts themselves.

Speak with your trusted Nexia Advisor if you have any questions about the matters discussed in this article or how we can help you navigate your tax obligations and identify opportunities.