All company directors need to apply for a Director Identification Number (DIN) through the Australian Business Registry Services (ABRS).

In summary

- All company directors must obtain a DIN, even if they are overseas residents.

- Existing directors at 31 October 2021 have until 30 November 2022 to obtain their DIN, including in relation to any additional directorships.

- Persons appointed as a director for the first time after 1 November 2021 must apply for a DIN within 28 days of their appointment.

- From 5 April 2022 a person must have a DIN before being appointed as a director.

- The DIN registration process opens 1 November 2021.

- Significant penalties apply for failing to obtain, misuse, or falsifying a DIN.

New laws require all directors to have a 15-digit Director Identification Number (DIN) which will be unique to each director. A director will only need to apply for a DIN once and they will keep their number forever even if the director changes their name,

their directorships, or ceases being a director.

The introduction of a DIN has the aim of:

- preventing the use of false or fraudulent director identities;

- making it easier for external administrators and regulators to trace directors’ relationships with companies over time; and

- identifying and eliminating director involvement in unlawful activities, such as illegal phoenixing activities.

The Treasury Laws Amendment (Registries Modernisation and Other Measures) Act 2020 introduces these new requirements into a new Part 9.1A of the Corporations Act 2001 and Part 6-7A of the Corporations (Aboriginal and Torres Strait Islander) Act 2006.

Who needs a DIN?

A DIN will be required if you are a director or alternate director of:

- Corporations Act entities – meaning companies, registered foreign companies, or companies that are responsible for managed investment schemes; and

- Aboriginal and Torres Strait Islander corporations registered under the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act).

When do you need to apply?

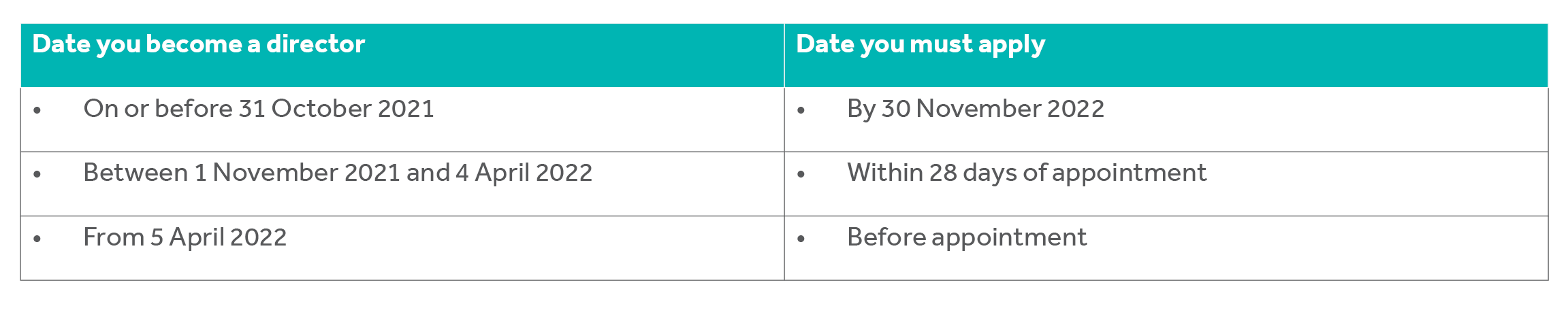

The date you will need to apply for your DIN depends on when you become a director as well as the type of corporate entity.

Corporations Act directors

If you are an existing director of a company at 31 October 2021 you have until 30 November 2022 to apply for a DIN, even if you are appointed to a new directorship during that time. However, if you are appointed as a director for the first time between 1 November 2021 and 4 April 2022, you will need to apply for a DIN within 28 days of your appointment. Otherwise, if you are appointed as a director for the first time after 5 April 2022, you will need to obtain a DIN before your appointment takes effect.

CATSI Act directors

Directors of Aboriginal and Torres Strait Islander corporations have additional time to apply for a DIN, as follows:

How to apply for your DIN

All directors must apply for their own DIN. Someone else, like your Nexia advisor, is unable to do this on your behalf.

Directors will apply for a DIN through the Australian Business Registry Services (ABRS) website (abrs.gov.au). The simplest way to apply is online using your myGovID. Further information on setting up a myGovID can be found at mygovid.gov.au. If you can’t get a myGovID, then from 1 November 2021 you will be able to apply either by phone or by using a downloadable application form available on the ABRS website.

To check what identity documents you will require for your application can also be found at the ABRS website or by clicking here.

What’s next?

Once you obtain your DIN, you will need to provide it to your company or Aboriginal and Torres Strait Islander corporation record-holder. This could be the company secretary, another director, contact person or an authorised agent of the company.

Initially, DINs will only be disclosed by the ABRS to certain commonwealth, state and territory government bodies, courts and tribunals or someone which the director has given permission to disclose to. It is intended that, eventually, the ABRS’s DIN register will be publicly searchable. The ABRS is managed by the Australian Taxation Office who is responsible for the implementation and administration of the program. However, ASIC will be responsible for the enforcement of offences relating to DINs.

Significant civil or criminal penalties may apply to a director, the company, and any advisors for conduct that undermines or breaches the new requirements, including failing to obtain a DIN when required, providing false identity information, and intentionally applying for several DINs.

If you have any questions, or would like any information on what these changes mean for you, please contact your Nexia Advisor.

Article by Martin Olde