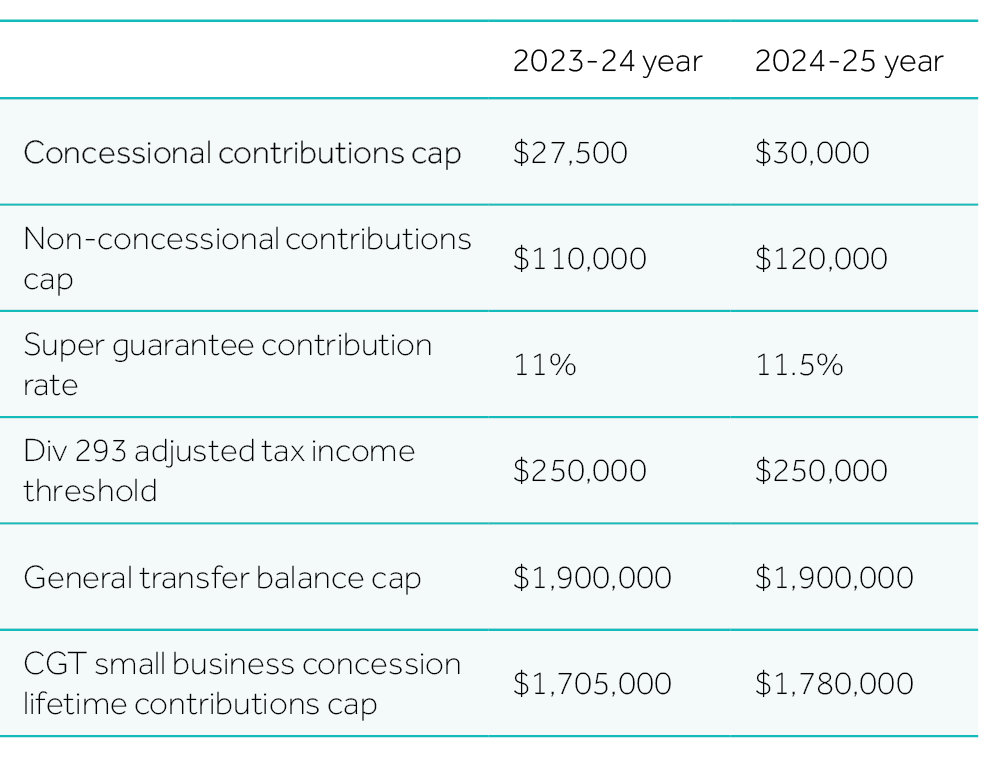

We summarise a number of important superannuation rates and caps for your convenience, especially where they have changed from 1 July 2024.

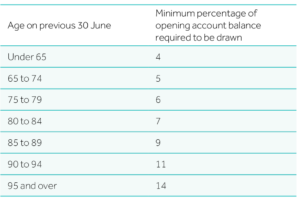

Minimum pension factors

If pension is commenced before 1 June, the minimum is prorated by the number of days in the financial year that includes and follows the commencement day.

If pension is commenced between 1 June and 30 June, no minimum payment is required.

In the year of a commutation the minimum is prorated by the number of days in the financial year up to the date of commutation.

A pre-commutation minimum payment is not required if:

In addition to the above minimums, transition to retirement pensions are subject to a maximum annual drawdown of 10% of the opening account balance, which is not prorated.

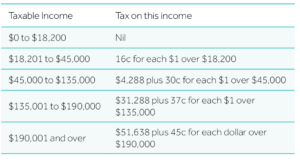

2024-25 Individual tax rates

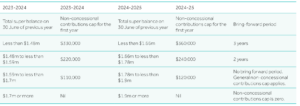

Bring forward periods and caps for non-concessional contributions.

In addition the member must be under 75 at some time during the tax year.