The Payment Times Reporting Act 2020 (the Act) introduces a new requirement for large businesses and large government enterprises with an annual total income over $100 million to publicly report on their payment terms and practices for their small business suppliers.

At a glance

- A large entity or group with annual total income of more than $100m will be required to prepare a Payment Times Report every 6 months

- A Payment Times Report includes information on the entity’s standard payment periods and the proportion and value of invoices that were paid within specified time bands to its small business suppliers during that period.

- A small business supplier is one that has annual turnover of less than $10 million.

The Payment Times Report must be lodged within 3 months after the end of each 6 month reporting period and will be made publicly available on a Payment Times Reports Register.

Who is affected?

The scheme starts on 1 January 2021 and applies to all companies and other constitutionally covered entities carrying on an enterprise in Australia where:

- the entity had a total income of more than $100 million, or

- if the entity is a controlling corporation – the combined total income for all members of the controlling corporation’s group was more than $100 million; or

- if the entity is a member of the group of a controlling corporation to which (2) applies—the total income for the entity was at least $10 million.

The Act cover most entities (both domestic and foreign entities), apart from those that lie outside the constitutional power of the Commonwealth to regulate. As a result, it applies to all companies, trusts, partnerships, unincorporated associations, and Commonwealth and Territory entities that are subject to the Commonwealth’s powers.

Nevertheless, the Act explicitly does not apply to entities registered under the Australian Charities and Not-for-profits Commission Act 2012.

Example 1:

P has three members, being subsidiaries A, B and C. P has standalone total income of $80 million. A’s total income is $50 million, B’s total income is $5 million. P, A and B all carry on an enterprise within Australia. C’s total income is $40 million but is a foreign entity that does not carry on an enterprise in Australia. The combined total income for all members of P’s controlling group is $175 million. Each of P and A are reporting entities because the combined total income of the group is more than $100 million and each entity has total income above $10 million. Each of P and A will all have to submit their own separate Payment Times Report. B has total income of less than $10 million and therefore does not need to submit a Payment Times Report. C is a foreign entity that does not carry on an enterprise in Australia and therefore does not need to submit its own Payment Times Report.

The Act refers to terms and concepts used in other legislation and requires careful analysis to determine which entities are within the scope of the Act. For example:

- The phrase ‘carrying on an enterprise’ is used in other legislation such as the Business Names Registration Act 2011 and broader than the phrase ‘carrying on a business’.

- The definition of ‘total income’ is referenced to the Income Tax Assessment Act 1997 rather than accounting standards, although the term is similar to gross accounting income.

- The term ‘controlling corporation’ refers to an Australian company that is not a subsidiary of another Australian company. In other words, a controlling corporation is a parent entity but not an intermediate Australian parent entity.

- The Act defines a ‘member of a controlling corporation’ as being a subsidiary under the Corporations Act 2001. A subsidiary is one where the controlling corporation controls the composition of the member’s board or controls more than one-half of the voting rights or holds more than one-half of the issued capital of the entity. Because the definition of control in Accounting Standards does not require more than 50% ownership or voting rights, it is possible that an entity is controlled for the purpose of AASB 10 Consolidated Financial Statements but is not a member of a controlling corporation for the purpose of the Act.

Example 2:

P has total income of $80 million and prepares financial statements that comply with Accounting Standards. P owns 47% of the issued capital and voting rights of A, which has total income of $50 million. Based on the absolute size of its holding and the relative size of the other shareholdings, P concludes that it has a sufficiently dominant voting interest to meet the power criterion and consolidates A in accordance with AASB 10. As a result, P’s annual financial report discloses consolidated total income of $130 million. As P does not own more than one-half of A’s issued capital or controls more than one-half of A’s voting rights, A is not a member of P’s controlling group. As a result, neither P or A is required to prepare a Payment Times Report.

How we see it

The Act predominantly uses terminology and concepts derived from the corporations and tax legislation. However, those concepts and terms do not necessarily align with Australian Accounting Standards. Entities and groups will need to closely examine whether they, and which entities within an accounting consolidated group, are subject to the Act.

Who is a small business supplier?

A small business is one that carries on an enterprise in Australia and its annual turnover (within the meaning of the Income Tax Assessment Act 1997) was less than $10 million for the most recent income year.

A Payment Times Small Business Identification Tool is being created by the Department of Industry, Science, Energy and Resources to assist entities identify which entities are determined to be small businesses. The Tool should be available in December 2020.

How we see it

At present, a number of questions exist over how entities will identify their small business suppliers and we await details of the final payment times reporting Rules and further clarity over the Act’s implementation.

What is required?

The Act does not mandate that small businesses must be paid within a certain period. Rather, affected entities will be required to prepare a Payment Times Report for each six months period which is designed to create transparency around the payment practices and times of a large business in paying its small business suppliers.

Reporting periods will be based on the income year for the reporting entity (the same as the financial year it uses for tax purposes). The first Payment Times Report will include information relating to the first six months of the year and a second report will include information for the remainder of that year. The reports will be lodged through a reporting portal with a new Payment Times Reporting Regulator, which will form part of the Department of Industry, Science, Energy and Resources.

The key items requiring disclosure in a Payment Times Report include:

- details of the entity, including whether it is part of a controlling group;

- the shortest and longest standard payment periods offered by the entity, as well any changes to these standard periods during the reporting period;

- the proportion (by number and value) of small business invoices paid by the entity in the following time bands:

- in less than 21 days,

- between 21 and 30 days,

- between 31 and 60 days,

- between 61 and 90 days,

- between 90 and 120 days and

- more than 120 days after the invoice was issued;

- the proportion, determined by total value, of all procurement by the entity during the period that was from small business suppliers.

When do I have to report?

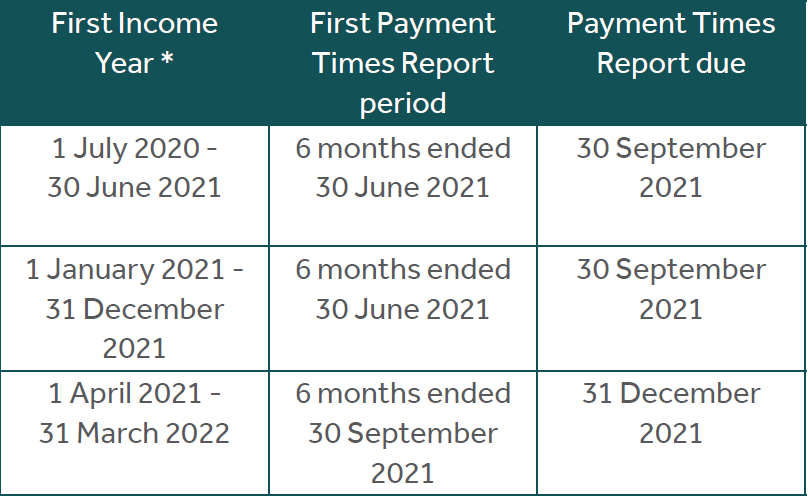

Reporting entities must lodge a Payment Times Report within 3 months of the end of each six month reporting period. For 30 June financial years, the first reporting period relates to the 6 months ending 30 June 2021. The following describes an entity’s first reporting timetable.

* Note: where the entity is subject to income tax, the income year is its year for income tax purposes. If an entity has a non-standard financial year for tax purposes it will use this non-standard financial year to determine when a Payment Times Report is due.

The Act contains penalties for entities that fail to report on time. The maximum penalties are currently $66,600 per day for a body corporate and $13,320 per day for an individual.

Will you be affected?

As the first reporting window commences on 1 January 2021, affected entities will need to develop an action plan to:

- identify which entities will be captured by the Act;

- ensure their standard payment periods are identified and documented;

- review the availability and quality of information that will be required to be reported;

- review and stratify supplier payment terms and average timeliness of payments. It may be helpful to consider if there are any significant outstanding supplier issues to resolve prior to the commencement of the reporting regime;

- consider whether accounts payable systems are capable of capturing and reporting the required information. For example, systems will need to be able to identify a small business sub-set of total accounts payable and generate the specific information required by the Act.

If you require assistance preparing for these changes, or for any further information, please contact your local Nexia Advisor.