Please note: This article was written in 2017. Contact our Nexia team for the latest advice.

AASB 9 Financial Instruments applies for reporting periods beginning on or after 1 January 2018 and replaces AASB 139 Financial Instruments: Recognition and Measurement.

AASB 9 applies, with some exceptions, to all types of financial instruments and introduces a new classification model for financial assets that is more principles-based than the previous requirements in AASB 139. A financial instrument is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

Financial assets

In simple terms, financial assets include cash; an equity instrument of another entity; a contractual right to receive cash or another financial asset from another entity or to exchange financial assets or financial liabilities with another entity under conditions that are potentially favourable to the entity.

Consequently, financial assets include such assets as:

- Cash at bank and deposits;

- Trade receivables and other debtors;

- Loans and other receivables;

- Bonds and convertible notes;

- Equity interests in other entities; and

- Derivatives, such as options, swaps and forward contracts.

Measurement model for financial assets

On initial recognition, a financial asset is measured at its fair value plus, in the case of a financial asset not at fair value through profit or loss, transaction costs that are directly attributable to the acquisition of the financial asset.

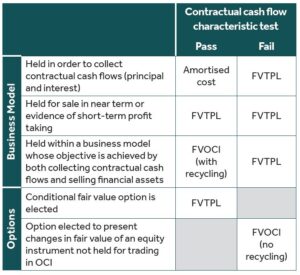

Financial assets are classified according to their contractual cash flow characteristics and the business model under which they are held. The following table summarises the AASB 9 classification and subsequent measurement requirements for financial assets:

Business model assessment

An entity’s business model reflects how it manages its financial assets in order to generate cash flows. Its business model determines whether cash flows will result from collecting contractual cash flows; selling the financial assets; or both. This assessment is performed on the basis of scenarios that the entity reasonably expects to occur. An entity’s business model for managing financial assets is a matter of fact and it is typically observable through particular activities that the entity undertakes to achieve its stated objectives. An entity will need to use judgement to assess its business model for managing financial assets and that assessment is not determined by a single factor or activity.

Contractual cash flow characteristic test

The assessment of the characteristics of the contractual cash flows aims to identify whether the contractual cash flows are ‘solely payments of principal and interest on the principal amount outstanding’. Hence, the assessment is often referred to as the ‘SPPI’ or ‘basic loan features’ test. This test is based on the premise that the variability in the contractual cash flows should only occur to maintain the holder’s return in line with a basic lending arrangement. Examples of instruments that would pass the SPPI test include ‘plain vanilla’ loans, trade receivables and debt securities with simple cash flows.

To satisfy the SPPI test the contractual terms of the instrument can not introduce a more than de minimis exposure to risks or volatility in the contractual cash flows that is unrelated to a basic lending arrangement, such as exposure to changes in equity prices or commodity prices. Hence, instruments subject to leverage, convertible bonds or notes, loans with embedded features and coupons linked to factors other than credit risk or passage of time would fail the SPPI test.

Equity instruments designated as FVOCI

Equity instruments are measured at fair value with changes in fair value recognised through profit and loss (“FVTPL”) unless the entity chooses, on an instrument-by-instrument basis on initial recognition, to present fair value changes in other comprehensive income (“FVOCI”). Dividends received on these investments are recognised in profit or loss unless the distribution clearly represents a recovery of part of the cost of the investment (eg, a return of capital).

This option is irrevocable and applies only to equity instruments, which are neither held for trading nor are contingent consideration in a business combination.

For the purpose of this election, ‘equity instrument’ is used in AASB 9 as defined in AASB 132 Financial Instruments: Presentation. Paragraph 11 of AASB 132 specifies that, as an exception, an instrument that meets the definition of a financial liability is classified as an equity instrument by the issuer if it has all the features and meets the conditions in paragraphs 16A and 16B (puttable instruments) or paragraphs 16C and 16D (entitlement to a pro rate share of net assets on liquidation) of AASB 132. As the classification of these instruments are treated as an exception to their defined nature, they are not eligible for the FVOCI election. For example, the FVOCI option is not available to a holder of redeemable units in a trust (as these instruments meet the definition of a financial liability for the trust), notwithstanding those units may be presented as equity in the trust’s financial statements.

Unlike debt instruments, gains and losses on equity instruments recognised in OCI are not recycled on disposal of the asset and there is no separate impairment accounting. If the fair value of the equity instrument declines, this decrease is recorded by the holder through OCI. This could result in the equity reserve having a significant debit balance.

Unlisted equity investments

Paragraph 46(c) of AASB 139 allows an entity to measure investments in equity instruments at cost if those instruments do not have a quoted price in an active market and their fair value cannot be reliably measured. AASB 9 contains no such exception and investments in equity instruments (other than those in subsidiaries, associates or joint ventures) need to be measured at fair value in accordance with AASB 13 Fair Value Measurement.

Fair value option

Notwithstanding the criteria described above for debt instruments to be classified at amortised cost or at FVOCI, an entity may irrevocably designate a debt instrument as FVTPL on initial recognition if doing so eliminates, or significantly reduces, an accounting mismatch. The presence of an accounting mismatch is the only situation in which the fair value option is available for financial assets. The FVTPL option is generally only relevant to financial assets and financial liabilities that would be otherwise measured at amortised cost because, as seen in the table on page 1, most other financial assets are already measured at FVTPL.

The notion of an accounting mismatch involves two propositions. First, that an entity has particular financial assets and liabilities that are measured on different bases; and second, that there is an economic relationship between those assets and liabilities. For example, an entity may enter into an interest rate derivative to manage the interest rate risk of a liability. In the absence of any particular designation, the derivative is measured at fair value through profit or loss and the related liability is measured at amortised cost. In such circumstances, an entity may conclude that its financial statements would provide more relevant information if both the asset and the liability were measured at fair value through profit or loss. The fair value option may be useful in instances where the arrangement does not qualify for hedge accounting.

Impairment model

The impairment requirements for financial assets are based on a forward-looking expected credit loss (“ECL”) model. The model applies to debt instruments measured at amortised cost or at FVOCI, such as lease receivables, trade receivables and contract assets (as defined in AASB 15).

AASB 9 contains three approaches to assessing impairment:

- The simplified approach, which will be applied to most trade receivables;

- The general approach, which will be applied to most loans and debt securities; and

- The purchased or originated credit-impaired approach.

The simplified approach requires the recognition of lifetime expected credit losses. Under this approach, an entity considers forward-looking assumptions and information regarding expected future conditions affecting historical customer default rates. It may also be necessary to group receivables into various customer segments where they may have similar loss patterns (e.g. by geography, product type, customer rating or type of collateral).

Under the general approach, entities must recognise ECLs in two stages. For credit exposures for which there has not been a significant increase in credit risk since initial recognition (i.e., ‘good’ exposures), entities are required to provide for credit losses that result from default events ‘that are possible’ within the next 12-months. For those credit exposures for which there has been a significant increase in credit risk since initial recognition, a loss allowance is required for credit losses expected over the remaining life of the exposure, irrespective of the timing of the default.

For purchased or originated credit-impaired receivables, the fair value at initial recognition already takes into account lifetime expected losses. At each reporting date, the entity updates its estimated cash flows and adjusts the loss allowance accordingly.

Under each of the impairment approaches, the loss allowance reduces the carrying amount of the financial asset. That is, it reduces the gross carrying value rather than recognising an impairment loss as a separate ‘provision’ against the gross value of the receivable.

Financial liabilities

Financial liabilities include:

- a contractual obligation to deliver cash or another financial asset to another entity, or to exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the entity; or

- a contract that will or may be settled in the entity’s own equity instruments and is:

- a non-derivative for which the entity is or may be obliged to deliver a variable number of the entity’s own equity instruments; or

- a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments.

Financial liabilities include such items as:

- Trade creditors and other accruals;

- Bank borrowings and overdrafts;

- Loans and other payables;

- Issued bonds, debentures and convertible notes; and

- Derivatives, such as options, swaps and forward contracts.

AASB 9 does not apply to liabilities that are within the scope of other Accounting Standards, for example employee entitlements recognised under AASB 119 and provisions recognised under AASB 137, even though they may give rise to an obligation to deliver cash to another entity.

Measurement model for financial liabilities

On initial recognition, a financial liability is measured at its fair value minus, in the case of a financial liability not at fair value through profit or loss, transaction costs that are directly attributable to the issue of the financial liability.

After initial recognition, a financial liability is subsequently measured at amortised cost except for the following liabilities which are measured at fair value with subsequent changes recognised in profit or loss:

- Derivatives;

- Financial guarantee contracts;

- Commitments to provide a loan at a below-market interest rate;

- Contingent consideration recognised by an acquirer in a business combination to which AASB 3 applies; and

- Other financial liabilities for which the fair value option described above has been applied.

Hedge accounting

The objective of the new hedging requirements is to reflect the effect of an entity’s risk management activities in the financial statements. This includes replacing some of AASB 139’s arbitrary rules with more principles-based requirements and allowing more hedging instruments and hedged items to qualify for hedge accounting.

Most of the basics of hedge accounting do not change as a result of AASB 9. Hedge accounting remains optional and there are still three types of hedging relationships: fair value hedges; cash flow hedges; and hedges of net investments in foreign operations. At inception of a hedging relationship there still has to be formal designation and documentation (including how the entity’s risk management objective underlying the hedging relationship fits within the overall risk management strategy). The hedge documentation must include an identification of the hedging instrument, the hedged item, the nature of the risk being hedged and how the entity will assess whether the hedging relationship meets the hedge effectiveness requirements.

The main changes between the previous hedge accounting requirements and those in AASB 9 include:

- The removal of the retrospective and the quantitative 80-125% hedge effectiveness tests;

- Permits risk components of non-financial items to be designated as the hedged item, provided the risk component is separately identifiable and reliably measureable;

- The time value of an option, the forward element of a forward contract and any foreign currency basis spread can be excluded from the hedging instrument and separately accounted for as ‘costs of hedging’;

- More items qualify for hedge accounting, including designations of groups of items, layer designations and some net positions as the hedged item.

Transition

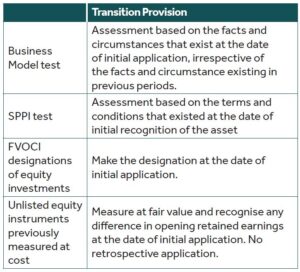

AASB 9 contains a general requirement that the Standard be applied retrospectively in accordance with AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors.

However, the Standard states that an entity can only restate prior periods, including restating comparatives for classification and measurement and impairment, where it can do so without the use of hindsight. AASB 9 also permits an entity not to apply AASB 9 to comparative interim periods prior to the date of initial application if doing so is impracticable.

A number of other special transition provisions also apply; the most common ones are discussed below. In general, these transition provisions require an entity to make an assessment or determination at the date of initial application and recognise any change in net assets in opening retained earnings (or OCI, as applicable) at the initial date of application.

Disclosures

AASB 9 and AASB 7 Financial Instruments: Disclosures contain significant and numerous disclosure requirements in the first year of adoption of AASB 9. Some of these include:

For each class of financial assets and financial liabilities:

- Original measurement category and carrying amount determined under AASB 139 and the new measurement category and carrying amount determined under AASB 9;

- Amount of any financial assets or liabilities in the statement of financial position previously designated at FVTPL but are no longer so designated.

Qualitative disclosures to enable users to understand:

- How the entity applied the classification requirements in AASB 9 to financial assets whose classification changed as a result of AASB 9; and

- The reasons for any designation or de-designation of financial assets or financial liabilities measured at FVTPL at the date of initial application.

For financial assets and financial liabilities reclassified to amortised cost and, in the case of financial assets, reclassified from FVTPL to FVOCI:

- The fair value of the financial assets or financial liabilities at the end of the reporting period; and

The fair value gain or loss that would have been recognised in profit or loss or OCI during the reporting period if reclassification had not occurred.

Next steps

This publication contains only an overview of the key elements of AASB 9. The implications for individual entities will depend on the nature, type and quantum of their financial assets and liabilities and the current accounting policies adopted. Entities need to carefully consider and assess the potential consequences of AASB 9 on the recognition and measurement of their financial instruments. If you require further information or assistance implementing AASB 9, please contact a Nexia Financial Reporting Advisory specialist.