This publication explores some of the potential effects of the new revenue standards on the education sector. It supplements our Accounting Updates Applying AASB 15 Revenue and Income of Not-for-Profit Entities and should be read in conjunction with those publications. This publication replaces the previous version dated May 2018 to incorporate amendments introduced by AASB 2018-8 Amendments to Australian Accounting Standards – Right-of-Use Assets of Not-for-Profit Entities.

Applying to not-for-profit entities for financial years commencing from 1 January 2019, AASB 15 Revenue from Contracts with Customers and AASB 1058 Income of Not-for-Profit Entities replace AASB 118 Revenue, AASB 1004 Contributions and a number of AASB Interpretations.

In this publication, we highlight some of the key impacts arising from the introduction of AASB 15 and AASB 1058 to entities in the not-for-profit education sector. Arrangements vary significantly between entities within the education sector and this publication does not attempt to address all the issues that may exist in those organisations. Institutions need to assess how their fee structure, sources of income, and terms and conditions relating to their specific arrangements may be affected by the introduction of AASB 15 and AASB 1058.

Application of requirements to schools

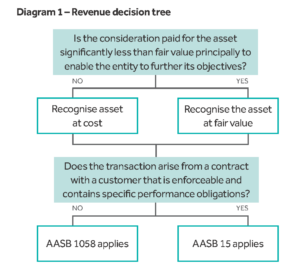

In considering the appropriate accounting treatment of income items, an analysis needs to be performed to determine whether the item is in scope of AASB 15.

Measurement of assets received

A not-for-profit entity is required to recognise an asset at fair value where the consideration for the asset is significantly less than fair value principally to enable the entity to further its objectives. For example, when a school receives a donation, bequest or grant it receives an asset, the consideration paid for which is significantly less than the fair value of the asset received, principally to enable the school to further its objectives. Hence, the school recognises the asset received at fair value. This concept also applies where the school is a lessee and the consideration paid to the lessor is significantly less than fair value principally to enable the school to further its objectives.

Identifying whether a contract with a customer exists

In order for a transaction to be accounted for under AASB 15, it must represent an agreement between two or more parties that creates enforceable rights and obligations and also contains performance obligation, being a promise to transfer to the customer a good or service.

In a school scenario, a form of written agreement between the school and the student’s family sets out both the school’s and the family’s rights and obligations. Acceptance of this arrangement between the school and family explicitly or implicitly obliges the school to provide tuition services for the relevant school year and for the family to comply with school policies, procedures and fee arrangements.

Typical income types

Schools and education providers broadly have the following sources of income:

- Tuition fees

- Initial fees (application and enrolment fees)

- Other fee income (IT, excursions, etc)

- Government grants

- Donations, fundraising and bequests

Initial fees

Initial fees include application fees, which are payable upon application of a position at a school or educational facility.

Application fees are usually non-refundable and does not guarantee an offer of placement at the school. It is likely that receipt of the application and the inclusion of a prospective student on a wait list is a distinct service. This is because the customer benefits from the service (the promise of inclusion on the wait list), such promise is separately identifiable, and the activity is not dependent upon the customer’s future decisions whether to accept or reject future placement. Consequently, application fees are recognised as revenue upon the school including the student on the wait list.

In addition, an enrolment fee is usually charged upon the acceptance of an offer for placement. In many cases, this fee is also non-refundable upon the withdrawal of the student from the school. In some cases, (and upon request of the student’s family), an enrolment fee may be credited against a student’s Year 12 (final year) tuition fees.

AASB 15 requires an assessment of whether an upfront fee represents an advance payment for future goods or services and, therefore, would be recognised as revenue when those future goods or services are provided. The revenue recognition period can extend beyond the initial contractual period if the entity grants the customer the option to renew the contract and that option provides the customer with a material right. Where a family has a right to enrol their child in subsequent years, or enrol siblings (whether at a discounted tuition fee or not), the school will need to assess whether the right represents a material right to the customer which would be accounted for as a separate performance obligation.

Depending on the terms and conditions relating to the enrolment fee, it is likely that such fee does not relate to a separate performance obligation but is highly dependent on, or highly interrelated with, other goods or services promised in the contract (ie, provision of tuition services over subsequent periods). In that case, the enrolment fee would represent an advance payment for future services and, therefore, would be recognised as revenue when those future goods or services are provided (that is, when the right is exercised). This may result in deferral of revenue in respect of that fee to later years.

Tuition fees

Tuition fees, fees for elective subjects and extra-curricular activities such as sporting activities are annual fees relating to the provision of tuition related services. The amount of annual fees may vary depending on the year level of the student and may incorporate discounts for siblings attending the same school. Often, pre-paid tuition fees may be refundable by giving one-term’s notice of withdrawal of the student from the school.

Tuition fees fall within the scope of AASB 15 and are recognised over the period to which the fees relate. As most schools have a 31 December balance date, tuition fees in relation to a school year would be recognised in relation to that same financial year. Tuition fees received in advance of a subsequent school year would be deferred and recognised as revenue in the relevant financial year.

Other fee income

These fees may incorporate other tuition-related services, such as contributions towards IT equipment (eg, laptops, other IT infrastructure and servicing), excursions or other outdoor or off-site activities and class resources.

These fees fall within the scope of AASB 15 and are recognised over the period to which the fees relate. Similar to tuition fees above, other fees received in advance of a subsequent school year would be deferred and recognised as revenue in the relevant financial year.

In some cases, it may not be clear whether the school is acting as principal or an agent in delivering some offsite activities, such as excursions, sporting activities, student overseas tours, etc.

When other parties are involved in providing goods or services to a school’s students, the school must determine whether its performance obligation is to provide the good or service itself (i.e., the school is a principal) or to arrange for another party to provide the good or service (i.e., the school is acting as an agent of the third party supplier). The determination of whether a school is acting as a principal or an agent will affect the amount of revenue it recognises. That is, when the school is the principal in the arrangement, the revenue recognised is the gross amount to which the school expects to be entitled. When the school is acting as agent, the revenue recognised is the net amount the school is entitled to retain in return for its services as the agent.

It is not always clear which party is the principal in a contract and careful consideration of the facts and circumstances of an arrangement is required.

Government grants

Government grants include any State, Commonwealth or local government grants. These may include recurring operating grants as well as grants for specific infrastructure or capital items.

Accounting for government grants follows the same process as described in Diagram 1, above. A school needs to analyse the specific terms and conditions relating to a government grant to determine whether it contains specific performance obligations, which may relate to the nature, type, cost, or quantity of goods or services to be delivered in return for the grant funding. Whether a grant contains requirements that are sufficiently specific as to qualify as a performance obligation is assessed separately for each promise and will depend on the facts and circumstances.

Where a school assesses that a grant contains sufficiently specific performance obligations, revenue is recognised as, or when, it satisfies those performance obligations.

However, a condition that a not-for-profit entity must transfer unspecified goods or services within a particular period does not, of itself, meet the ‘sufficiently specific’ criterion. For example, a condition that funds be spent by a school on education during the 2019 calendar year would not, of itself, satisfy the requirements in AASB 15, but rather be recognised as income immediately upon control of that grant under AASB 1058, irrespective of whether the grant related to a subsequent financial year.

AASB 1058 contains specific requirements in respect of grants to construct or acquire a non-financial asset, colloquially known as capital grants. Where a school receives a grant for the purpose of acquiring or constructing a non-financial asset to particular specifications or conditions (for example, a specific grant to construct a library to government specifications), income is recognised as or when the school satisfies its obligations to acquire or construct that asset.

Donations, fundraising and bequests

Schools may be the beneficiary of different forms of fundraising activities. These can include voluntary donations (whether for general operations or for nominated purposes such as building funds), specific fundraising activities (including fundraising dinners and raffles), as well as bequests.

An assessment of the individual terms and conditions of those receipts needs to be undertaken to determine whether such amounts:

- Arise from enforceable agreements that contain sufficient specific performance obligations relating to the use of those funds, in which case AASB 15 will apply to those receipts; or

- Create a contractual obligation to deliver cash or another financial asset to another party, for example cash scholarships or endowments payable to students, in which case a financial liability is initially recognised under AASB 9; or

- Do not arise from an enforceable agreement or do not contain sufficiently specific performance obligations relating to the use of those funds, or do not result in the recognition of any other amounts in accordance with other Accounting Standards, in which case income is recognised immediately upon control of the receipt under AASB 1058; or

- Satisfy the requirements relating to capital grants described above, in which case income is recognised as or when the obligations to acquire or construct an asset is satisfied.

Below-market leases

As described on page 1, AASB 1058 requires a not-for-profit entity to recognise an asset at fair value wherever the consideration paid for the asset is significantly less than fair value principally to enable the not-for-profit entity to further its objectives.

AASB 16 Leases, which is also applicable for financial years beginning on or after 1 January 2019, requires a lessee to recognise a lease asset and lease liability for all leases other than short-term leases and leases of low-value assets. A not-for-profit school needs to consider whether any lease arrangements contain below-market lease payments (including nominal or peppercorn rents).

In this scenario, when AASB 1058 is applied in conjunction with the new leases standard AASB 16, a school will be required to recognise:

- a lease asset either at cost (determined in accordance with AASB 16), or at fair value (that is, the fair value of the right to use the leased property during the lease term). This accounting policy choice is to be made on a class-by-class basis;

- a lease liability measured at the present value of the lease payments in accordance with AASB 16; and

- the difference between the initial measurements of the lease asset and lease liability immediately as income. Such a gain will only arise on below-market leases where the lease asset is initially recognised at fair value.

This accounting choice to recognise the effects of below-market leases at fair value is a significant change from current practice and will require not-for-profit entities to assess their current lease arrangements.

Customer credit risk

AASB 15 requires that revenue should be recognised at the amount to which the entity expects to be entitled, not what the entity expects to receive, in exchange for transferring the promised goods or services to the customer.

Therefore, adjustments are not usually made to the measurement of revenue to reflect a customer’s credit risk. Rather, after initially meeting the criteria to recognise revenue, a school refers to AASB 9 Financial Instruments to determine whether an impairment loss should be recognised for any amounts due that are not expected to be recoverable.

Conclusion

The introduction of AASB 15 and AASB 1058 have the potential to change the timing of revenue recognition for entities in the education sector. Nexia’s Financial Reporting Advisory specialists can assist you analyse the potential impacts of the new revenue model on your operations and whether any changes to your present accounting processes may be required.

If you are affected by these changes or have any questions about the new revenue model, get in touch with our team of specialists.