With 30 June approaching, we draw your attention to year-end tax planning strategies and compliance issues you need to consider to ensure you are in the best possible tax health.

Taking into account the most recent tax changes, this planner will focus on the most important issues to consider by businesses and individuals to best manage their tax exposure in respect of the 2023-24 income tax year. Where relevant, we also mention proposed or upcoming tax changes that may affect your tax position in later years.

Tax planning is about taking control over the amount of money in your pocket. This manifests in managing risks, and capitalising on opportunities, to appropriately manage your tax exposure.

Whilst tax planning is all-year-round, there’s no doubt that coming up to 30 June heightens sensitivity to possible opportunities. This year features a number of new opportunities as well as risks to which we recommend that you give attention.

If you would like to discuss anything in this document, talk to your trusted Nexia Advisor.

Click here to download the PDF or click on one of the sections below to view:

If you would like to discuss anything in this guide, get in touch today via our online form, or talk to your trusted Nexia Advisor.

Business

1. Instant asset write-off

The tax depreciation rules returned to normal from 1 July 2023, which includes the instant asset write-off for small businesses (group-wide turnover below $10 million) for depreciating assets costing less than $1,000.

However, the government announced their intention to legislate increasing the threshold to $20,000 for the period 1 July 2023 to 30 June 2024, and further announced in the May 2024 Budget to extend this again to 30 June 2025.

However, neither extension has passed Parliament, with the Senate amending the proposed changes to a $30,000 write-off threshold and extending to medium businesses, via a $50 million turnover threshold. The House did not accept this, returning the amending Bill to the Senate, but the Senate has stood their ground.

The unfortunate stalemate might mean that neither change is legislated, leaving us with the $1,000 threshold. The uncertainty is unhelpful for business, especially where the business case for investing in a new asset is marginal, and the full deduction would tip the scales.

Accordingly, it may well be at the very least that the $20,000/$10 million thresholds will be extended to 30 June 2025. However, there is no guarantee until it has passed Parliament.

2. ATO focus on family trusts

Longstanding anti-avoidance rules in section 100A of the tax act can apply where trust income is appointed on paper to a beneficiary on a lower tax rate, but someone else gets the benefit of the underlying funds. This has received limited attention over the years, but the ATO has embarked on a compliance program with renewed focus on administering these rules. Of particular focus is appointing trust income to adult children, and the exclusion from these anti-avoidance rules where arrangements are entered into in the course of ordinary family or commercial dealing (which is not defined as to what that means).

The ATO has issued a ruling (TR 2022/4), setting out their views on these rules, as well as a Practical Compliance Guideline (PCG 2022/2), which sets out essentially whose tax arrangements will be subject to review, and whose won’t.

Trustees ought to have regard to these pronouncements when making decisions on the appointment of trust income leading up to 30 June 2024 and beyond. We can provide guidance in relation to your particular circumstances, to ensure you are making fully informed decisions in this respect.

3. Company tax and franking rates

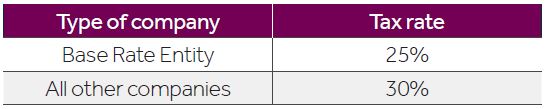

There are two company tax rates:

Tax Rate

A company is a Base Rate Entity (BRE) for an income year where is has group-wide business turnover below $50 million and no more than 80% of its income comprising passive income. BREs are subject to company tax at a rate of 25%. All other companies are subject to the 30% rate. A company can be a BRE one year, not a BRE in the next year, and so on. The applicable tax rate for the year changes accordingly.

Franking Rate

Dividends can have tax credits attached by franking them at either the 30% rate (ie, dividend x 30/70) or 25% rate (dividend x 25/75). The rate at which a dividend is franked and the company’s income tax rate for the year are determined independently of each other. Accordingly, a company might pay tax at one rate for a year, yet frank a dividend paid in that same year at the other rate. This can cause over-taxation, or leave you with unusable franking credits.

We can assist with managing your franking outcomes.

4. Allocation of professional firm profits

The ATO has instigated a program for determining when they will likely review the tax arrangements of professionals, and possibly progress to an audit. The issue in the ATO’s sights is whether an equity holder in a professional firm is taxed on a sufficient amount of their profit share from their firm, or is too much allocated to related parties on a lower tax rate.

The ATO’s Practical Compliance Guideline PCG 2021/4: Allocation of professional firm profits sets out the ATO’s approach to overseeing tax compliance amongst owners of professional firms in the fields of accounting, architecture, engineering, financial services, law, medicine, management consulting and others.

The PCG sets out criteria for qualifying to rely on it, and contains a risk scoring system. On a year-by-year basis, the tax arrangements of equity holders in professional firms in the above fields will fall into one of the following risk zones:

Decisions on the allocation of professional firm profits ought to take into account the ATO’s compliance approach. We can help you make these decisions.

5. Concession available for small business entities

Businesses that are small business entities (group-wide turnover below $10 million) may qualify for the following tax concessions in the 2023-24 income tax year:

- Immediate deduction for depreciating assets;

- Small business restructure rollover;

- Immediate deduction for start-up costs;

- Immediate deduction for certain prepaid expenses;

- Simplified trading stock rules;

- Simplified PAYG tax instalment rules;

- Cash basis accounting for GST, ATO-calculated GST instalments;

- and FBT exemption for car parking, providing multiple portable electronic devices (eg laptops, mobile phones).

6. Superannuation Guarantee increase

From 1 July 2024, the Superannuation Guarantee (SG) rate for compulsory superannuation contributions by employers will increase from the current 11% to 11.5%. The rate is applied to an employee’s Ordinary Time Earnings.

SG was always intended to be an income sacrifice by employees. Depending on applicable awards or employment contractual arrangements, the salary component of an employee’s remuneration might need to change from 1 July due to the increase in the rate.

7. General business issues

Manage your private company loans

Integrity rules exist to combat accessing company funds in a tax-preferred manner that have been taxed at the company rate, instead of by extracting as a dividend. The rules exist due to the wide gap between the company tax rate of 30%/25% and the top personal tax rate of 47%.

Care must be taken when a private company makes a loan or payment to a shareholder (or the shareholder’s associate), or forgives a debt owed by a shareholder (or associate). Also, where a trust appoints trust income to a private company beneficiary without the cash payment to the company; such unpaid present entitlements (UPEs) made from 16 December 2009 by a trust to a company may be treated as either a loan by the company to the trust or remain a UPE (if put on sub-trust in limited circumstances).

This is a very complicated area of tax law, but is relevant for many businesses, so please speak to your Nexia advisor regarding any form of advance or credit from trusts or companies to associated parties.

Review your trust deeds and make trust resolutions by 30 June

Trustees must generally make valid resolutions before 30 June (or an earlier date if specified in the trust deed) to appoint trust income to beneficiaries. If trustees fail to make valid appointment resolutions before 30 June, the trustee can potentially be assessed on all the Trust’s taxable income at the top marginal tax rate (i.e. 47%).

Also note that beneficiaries must quote their TFNs to trustees before a trustee appoints trust income to them for the first time – failure to do so will result in the trustee being liable to withhold tax at 47% from the trust income appointed to the beneficiary.

To ensure that valid trustee income appointment resolutions are made, the terms of the Trust Deed must be complied with.

In relation to the choice of beneficiaries to whom trust income is appointed, refer to Business items 2 and 4.

Review your bad debts and obsolete plant and machinery

Before 30 June, outstanding debtors should be reviewed to determine the likelihood of not receiving payment and whether attempts to recover the debts will be successful (keep documentation to evidence that the debt is considered to be non-recoverable). If the debt is irrecoverable and if income is reported on an accruals basis, the debt can be regarded as a bad debt for which a tax deduction may be claimed. This process must occur before 30 June.

This same methodology applies to scrapping obsolete plant and machinery. In such a case you should review your asset register, identify, scrap (i.e. physically dispose of) and claim a deduction for the written down value of such assets.

Value trading stock at the lower of cost, market selling value or replacement value

The valuation of trading stock at year-end may impact on the amount to be included in assessable income for the 2023-24 income tax year.

Because a lower closing value for trading stock may result in a lower taxable income, taxpayers have the choice of valuing trading stock on hand at 30 June as the lower of cost, market selling value or replacement value.

Or, value stock at the higher of the above three options

If your business has suffered a reduced level of profit this year, or even a loss, consider this alternative. You can choose amongst the three valuation options for year-end stock on hand on an item-by-item basis. You can possibly achieve a better tax outcome by increasing 2023-24’s taxable income to a more optimal level, or eliminate a tax loss, thereby avoiding the need to address complex integrity rules for carrying forward tax losses. The law expressly allows you to make these choices, and whilst they produce only a timing difference for your business’s taxable income, the right combination of choices can achieve a permanent tax saving.

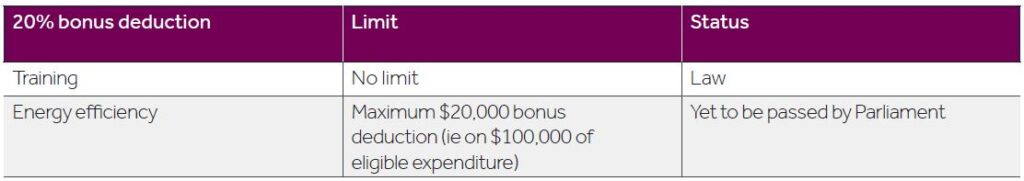

120% deduction for skills and training expenditure, energy efficiency

Until 30 June 2024, businesses with group-wide turnover of less than $50 million will receive an additional 20% deduction for eligible expenditure on training employees, and investments that support energy-efficient practices and implementing energy-saving technologies.

8. Single Touch Payroll

All employers are now required to run their payroll and pay their employees through accounting and payroll software that is Single Touch Payroll (STP) ready.

If you are still having STP issues, please talk to us so that we can assist you with STP compliance.

9. Certain industries must report payments to contractors

Businesses in the building and construction, cleaning, courier, road freight, IT, and security, investigation or surveillance industries must lodge a taxable payments annual report (TPAR) by 28 August 2024. The report includes the total payments they make to contractors.

Individuals

1. Revised Stage 3 tax cuts

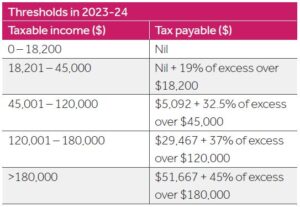

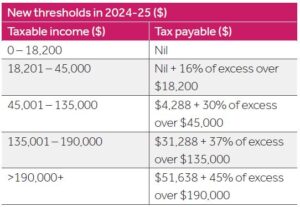

The current rates and thresholds, and as of 1 July 2024, are as follows (excludes the 2% Medicare levy):

There may be some limited opportunity to bring forward an allowable deduction into the 2023-24 income year and obtain a tax saving due to the deduction being claimed at a higher income tax rate.

2. Deduct work-related expenses

Taxpayers who are over-claiming work-related expenses (e.g. vehicle, travel, internet and mobile phone and self-education) are on the ATO’s hit list.

Although a myriad of tax law considerations is involved when claiming work-related expenses, the three main rules are:

- Only claim a deduction for money actually spent(and not reimbursed);

- The work related expense must directly relate to the earning of income; and

- You must have a record to prove the expense.

Working from home – running expenses

Many people have been working from home for an extended period. A fixed rate method continues to be allowed for calculating your allowable deduction arising from working from home.

You can claim a deduction of 67 cents for each hour you work from home, as a representation of all additional deductible running expenses as a result of working from home. However, there are still some record keeping requirements.

You do not have to have a separate or dedicated area of your home set aside for working, such as a private study.

Alternatively, the actual work-related portion, calculated for all running costs, continues to be available as usual.

3. Manage your general exposure to capital gains tax

If suitable, delay the exchange of contracts to sell an appreciating capital asset until after 30 June 2024. That way, the capital gain will only be assessable in the 2024-25 income tax year.

If you have already made a capital gain this year, you may wish to crystallise capital losses (e.g. by selling shares that have declined in value) to reduce the capital gain. However, when adopting this strategy, ensure that you are not engaging in “wash sales” (where you sell shares shortly before 30 June solely to realise the capital loss, and then buy the shares back shortly after 30 June).

Also, a capital gain will be eligible for the 50% CGT general discount to the gross gain if the asset has been held for at least 12 months before sale.

4. Superannuation

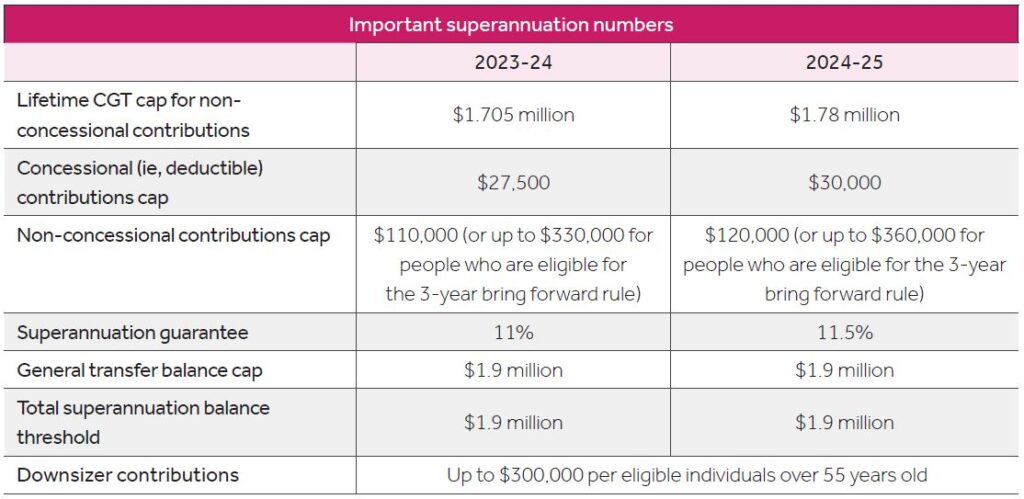

Pay superannuation contributions before 30 June

Both employees and self-employed individuals can claim a tax deduction annually to a maximum of $27,500 for personal superannuation contributions, provided the superannuation fund has physically received the contribution by 30 June 2024 and the individual has provided their superannuation fund with a notice of intention to claim.

Employees can also top-up their employer’s superannuation guarantee contributions to the $27,500 limit.

Payments to a superannuation fund should be made sufficiently in advance of 30 June to ensure there is time for the payment to be processed and credited to the fund’s bank account by 30 June.

If it is not credited to the fund’s bank account by 30 June, the deduction will be deferred to the next income year.

From 1 July 2024, the annual deductible threshold will increase to $30,000.

Superannuation rates and caps

Here is a short summary of the most important superannuation rates and caps that apply for the 2023-24 and 2024-25 income years:

Remember that employed people can make concessional (ie, deductible) contributions directly to their superannuation fund. They do not need to enter into a salary sacrifice arrangement with their employer.

Catch-up contributions to superannuation

If your superannuation balance is below $500,000 as at the previous 30 June, you can contribute more to superannuation than the annual $27,500 deductible contribution cap where your contributions in prior years were below the concessional contribution cap. Employer contributions are counted for this purpose, and there are contribution and timing limits.

5. First Home Super Saver Scheme

A first home buyer can salary sacrifice a maximum of $15,000 a year (take care not to breach the $27,500 concessional contributions cap) to save for a deposit to buy a first home.

The maximum amount that can be saved in such a way is $50,000 across all years. Provided the buyer’s partner does not already own his or her first home, the couple can put in a maximum of $100,000 ($50,000 x 2) to buy a first home.

Money saved in this way can only be withdrawn from the superannuation fund with strict rules applying on how to use such withdrawn money (e.g. must buy a home within a certain time and the ATO must be notified of the withdrawal).

Withdrawn funds are subject to income tax at your marginal rate, less a 30% rebate.

Not-for-profit

1. Annual self-review return

From the 2023-24 income year, non-charitable Not-for-profits (NFP) with an active Australian Business Number need to lodge an annual return. In the return, NFPs will self-review to self-assess their ongoing eligibility to be exempt from income tax.

The return can be lodged through the ATO’s Online services for business from 1 July 2024 and is due by 31 October 2024. A new return must be lodged each income year after that. Nexia Australia will contact all of our NFP clients in due course to assist with this new compliance obligation.

Next steps

Tax is complicated and is constantly changing. Quite possibly strategies used in the past have become outdated and may not work for you anymore.

Add to this the ATO’s renewed focus on compliance and collection, including specific compliance programs targeting professional firms and trusts, past practices may require re-evaluating. We hope that this Tax Planner helps you to identify some extra ideas for tax time to assist you in operating your business more tax efficiently and effectively.

Please speak to your trusted Nexia Advisor if you would like to discuss any of the strategies mentioned or would like us to perform a financial and tax health check on your business.