Throughout your life you will go through a number of key life events that will significantly impact you. Due to the changes that often come hand-in-hand with these types of events there are a number of adjustments that need to be made to your affairs. One of these adjustments, that is regularly overlooked, is updating your insurances. Ensuring you are correctly covered for the next stage of your life is essential to mitigating any risk that could happen to you or your family.

Did you know a lot of retail and industry super funds allow you to increase your cover without going through any medical or financial Underwriting?

This option is available for the following key life events:

- Marriage

- Birth or adoption of a child

- New mortgage (for the initial purchase of a primary residence only)

- Divorce

- Death of your spouse

- First becoming eligible for a Department of Human Service’s carer’s allowance

- Your child’s first day at primary or secondary school.

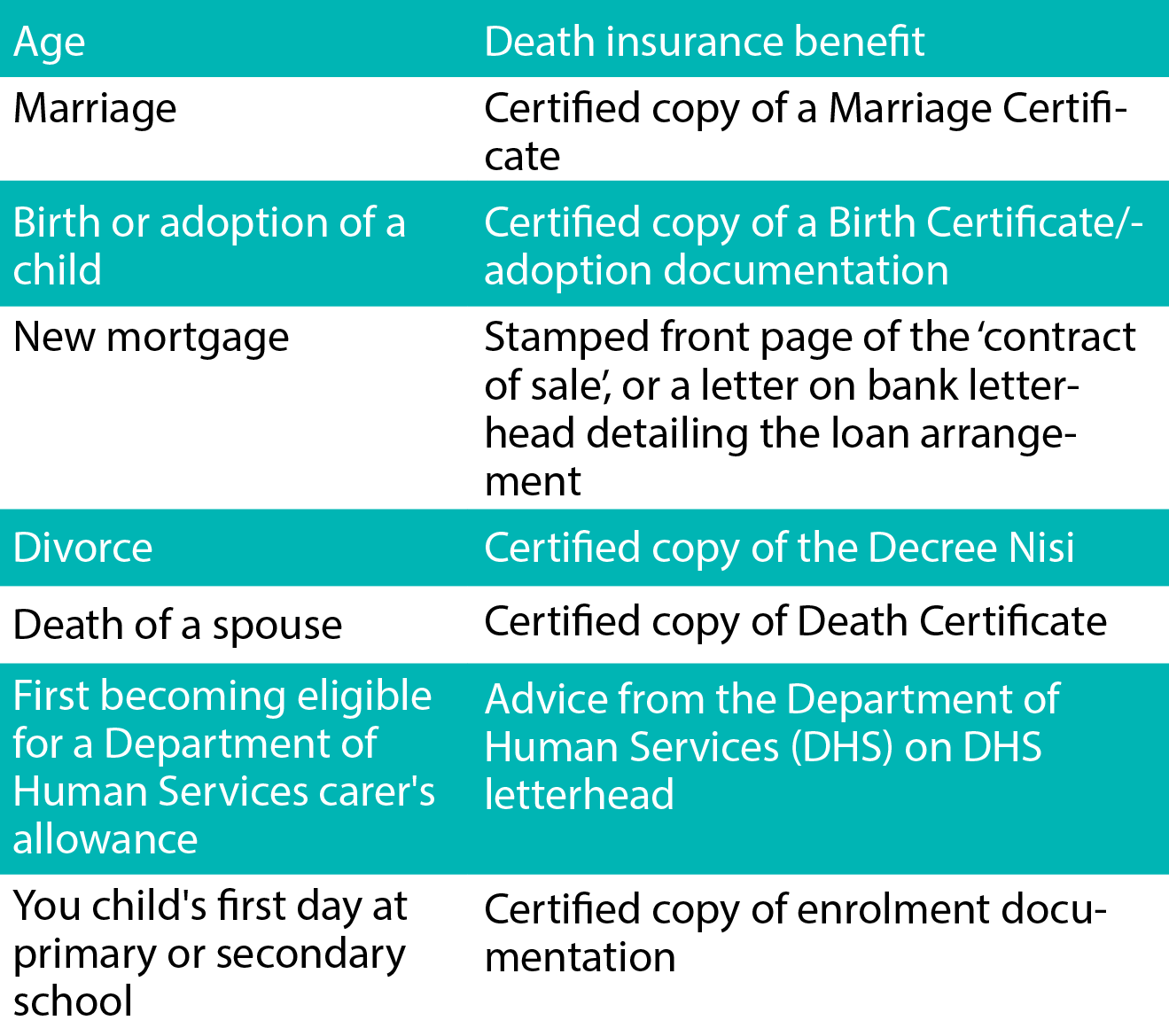

What evidence would I need to provide?

Examples of evidence for some of these life events are as follows:

The key life events option can only be taken up once in any 12 month period by an insured member. For example, if you apply for an additional unit after getting married, you would not be eligible to apply for any other event (such as a new mortgage) within the same 12 month period.

Cost associated with increasing your cover

The cost of the increase in premium will apply depending on your age and level of cover you are wanting to increase by.

Does this apply to you?

If you have recently had a key life event change and you are looking to make adjustments for the next stage of your life - our Nexia Advisers can work with you through this process.