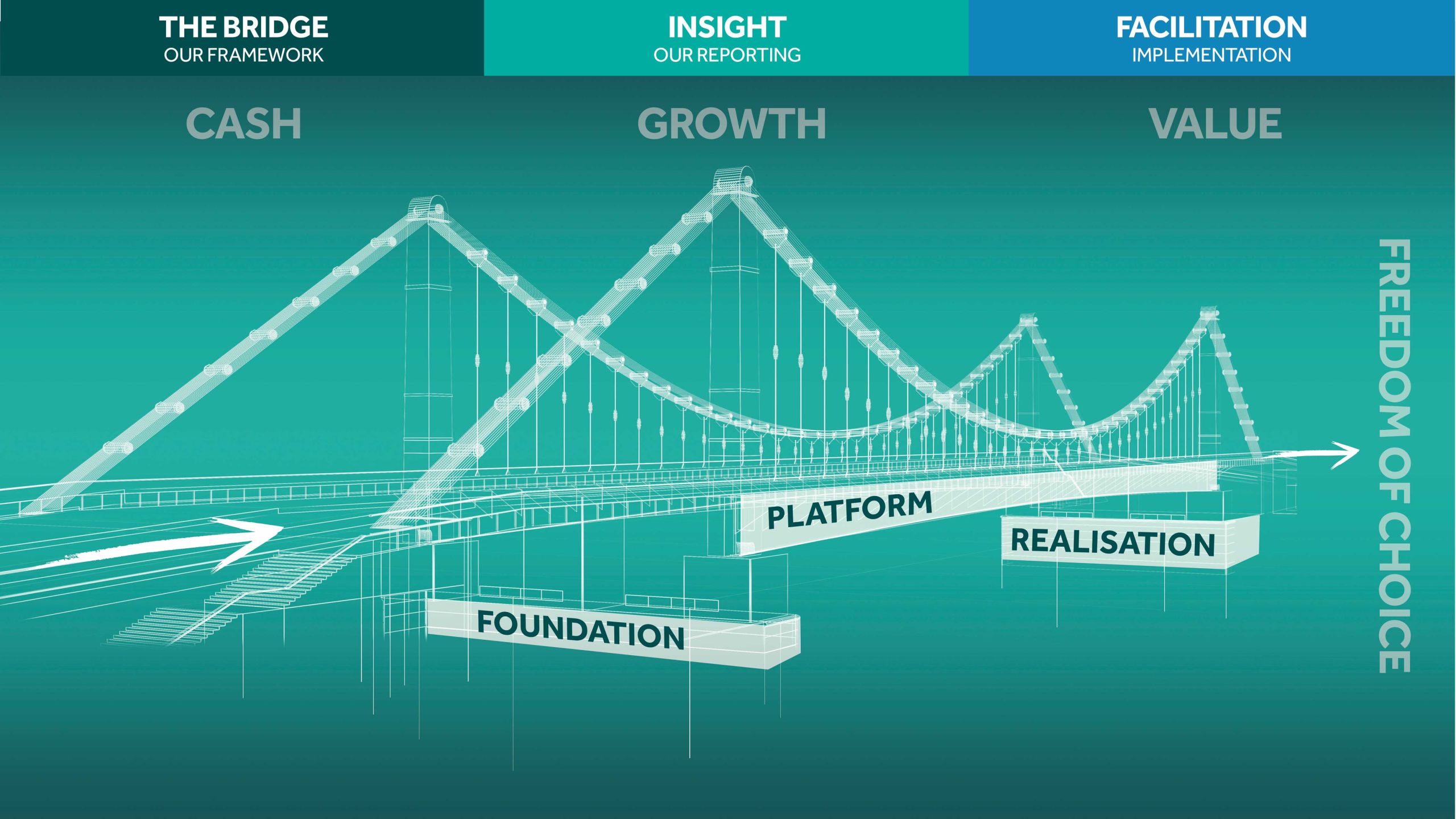

Cash Growth Value

Nexia Perth

The road to success is littered with an endless procession of spot-fires, all demanding immediate attention. The challenges can overwhelm: financial restrictions, time constraints and strained resources are but the tip of the iceberg.

Opportunities present but are you placed to capitalise?

For business owners, it's concerning and may lead to wondering:

- What happened?

- Where am I heading?

- How long can I keep going?

- When should I get out?

- How do I get out?

- Who can help me gain perspective?

Your family and business are important. You work long hours and to fund expansion, every last dollar counts. Perhaps retirement is on the horizon and you’re looking to extract maximum value on business sale.

What you need is a partner to help navigate the complex and increasingly competitive business environment. A team of advisors who open doors and offer freedom of choice opportunities.

What you want is options.

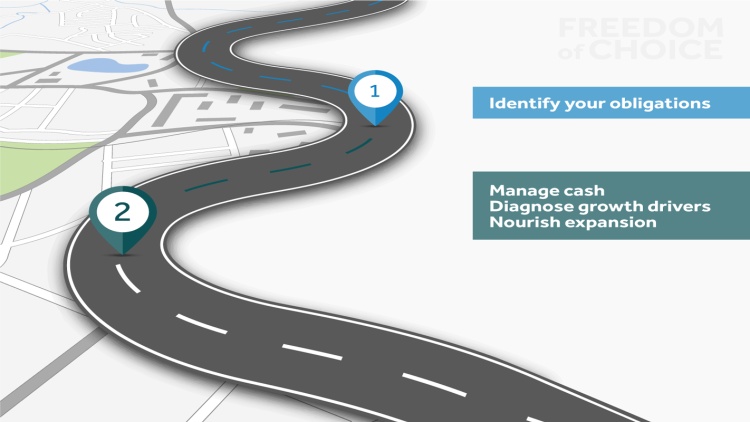

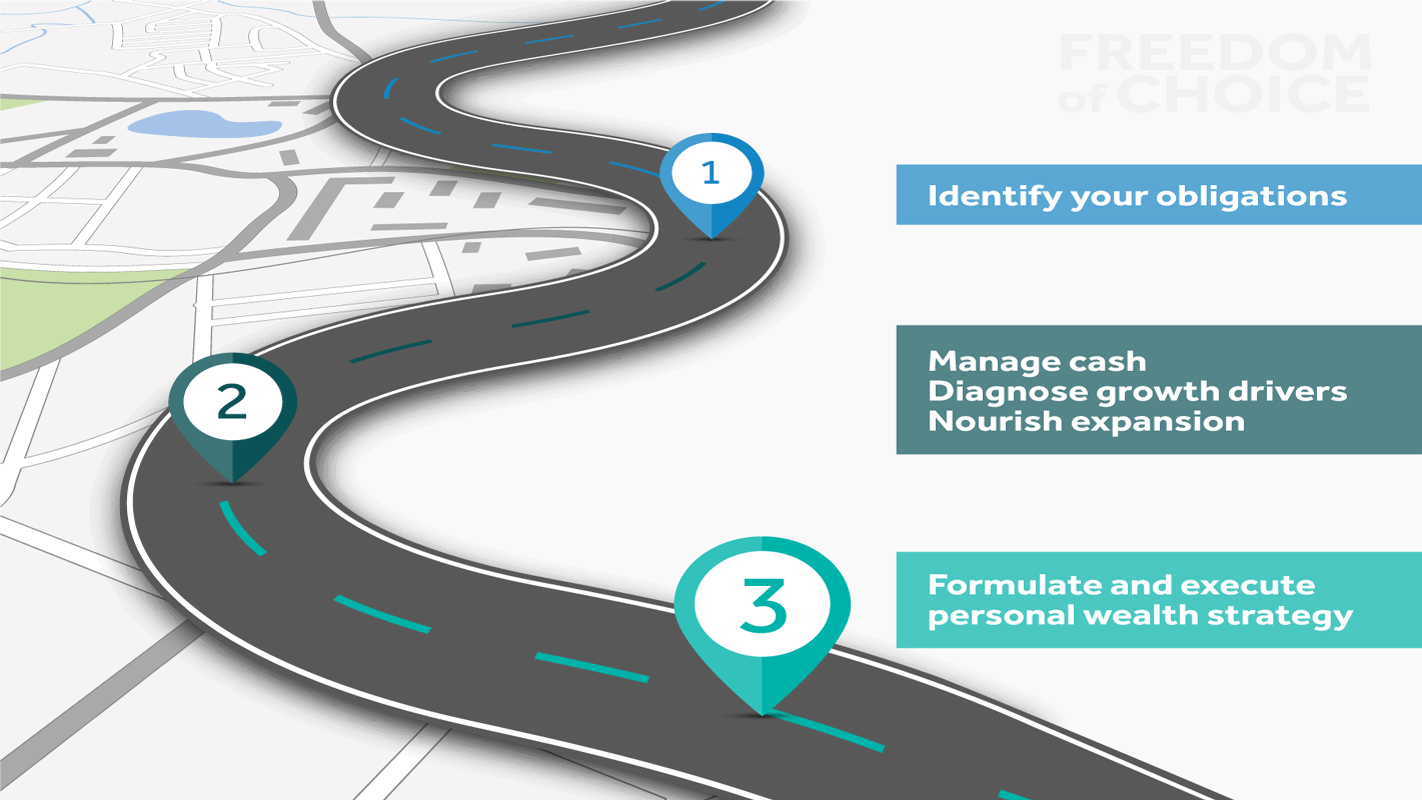

How do I open up freedom of choice opportunities?

You need advisors who can:

- Identify your obligations.

- Manage your cash, diagnose critical growth drivers and nourish expansion.

- Formulate and execute your personal wealth strategy.

Think of this approach as a bridge. What’s the purpose of a bridge?

It spans, links and connects. To otherwise inaccessible locations, a bridge provides support and access. Bridges are designed and built in phases and our method is no different.

"To otherwise inaccessible locations, a bridge provides support and access."

Nobody said it would be easy. That’s why you need a travelling companion.

A lateral-thinking and forward-looking ally skilled in dealing with complex matters and encourages you to dream big, take control and roam free.

A partner who diagnoses and provides solutions to problems and equips you with information and insights to inform decision-making.

A team who minimise unwanted surprises and provide a platform to scale your business, invest your wealth, realise your desired lifestyle and above all else, enable choice.

Bridge Building - Part 1

Manage Compliance

Compliance ensures an entity meets the requirements of prescribed rules and regulations, legislation, accepted practices, specified standards or the terms of a contract.

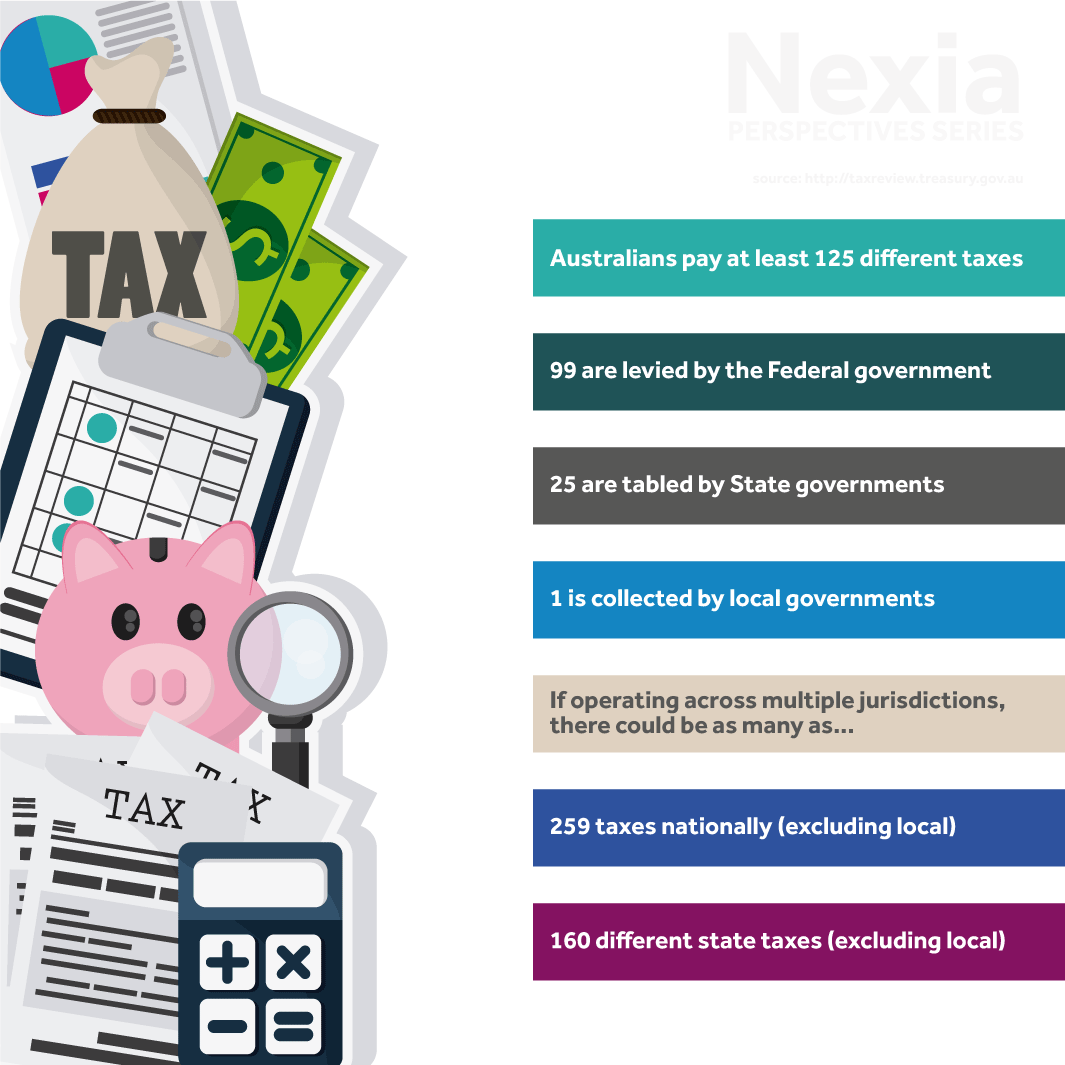

In theory, compliance promotes accountability and transparency where in reality, it can become a burdensome exercise.

Consider taxation. There’s income tax rates for individuals, companies, superannuation funds, partnerships and trusts, fringe benefits tax, goods and services tax, business activity statements, instalment activity statements, capital gains tax, PAYG and that only begins to scratch the surface.

With minimal consideration, tax quickly becomes convoluted.

Ongoing government regulatory reform further complicates matters. The Australian government has committed to cutting $1 billion worth of red tape and green tape each year. This is where Nexia puts our accounting and advisory expertise to work. Our foundation is built on a bedrock of compliance.

In fact, it’s in our DNA.

That’s why we begin by setting the foundation or in plain English, we get the structures right. It is our job to know, inside-out, prescribed rules and regulations, legislation, accepted practices, specified standards and the terms of contracts applicable to your business.

"It is our job to know."

To manage your needs effectively and efficiently, we invest in and empower our staff. We stay abreast of industry and regulatory developments to ensure your obligations will be met and where appropriate, Nexia identifies and recommends opportunities ripe for capitalisation.

We do all this to ensure there are no surprises, minimise tax and capture opportunities to put money back in your pocket.

Earn it. Keep it. Grow it.

Bridge Building - Part 2

The Business

In business, you can’t afford to stand still.

In an era of accelerating technological advancement, the seemingly exponential rate-of-change and transnational competition, improving your competitive standing has never been more important.

With this in mind, Nexia takes an over-the-horizon approach. We work with business owners to identify and strategise how best to reach their long-term goals.

We do this with the understanding that to achieve your objectives, long-term planning must align with short-term drivers. Experience suggests along your journey, a few stop-offs will be required.

Welcome to Nexia Live.

Cash is king. It affords greater protection against defaults or foreclosures, entrenches you in a more stable financial position, improves your purchasing power and provides flexibility when approaching vendors.

Consider your position when applying for a long-term business loan or establishing short-term credit accounts. Borrowing is a withdrawal from future cash flow used to make purchases now.

A demonstrably strong cash flow is an indicator of financial health and to lenders, is appealing. If accessing finance is difficult, revisiting your cash flow is paramount.

Achieving growth isn’t straightforward nor is it easy. Are you defensive and reactionary or do you think strategically and act proactively? Have you considered activities or strategies that are most likely to drive growth?

Have you positioned your business to achieve these outcomes?

Whether it's building new locations, investing in R&D, renovating infrastructure, upgrading legacy systems, providing training to staff or purchasing assets and inventory, it's vitally important to identify and focus on driving activities that encourage growth.

Ultimately, you’re working to achieve an optimal return on investment. That requires in-depth and up-to-date knowledge of company assets, liabilities, company resale value and true company value.

Facilitating value increase will inform your position during mergers, acquisitions and buy-outs. Should you choose to expand, it will provide access to investors and enables flexibility in responding to emerging dilemmas.

It’s about maximising value and putting more money in your pocket.

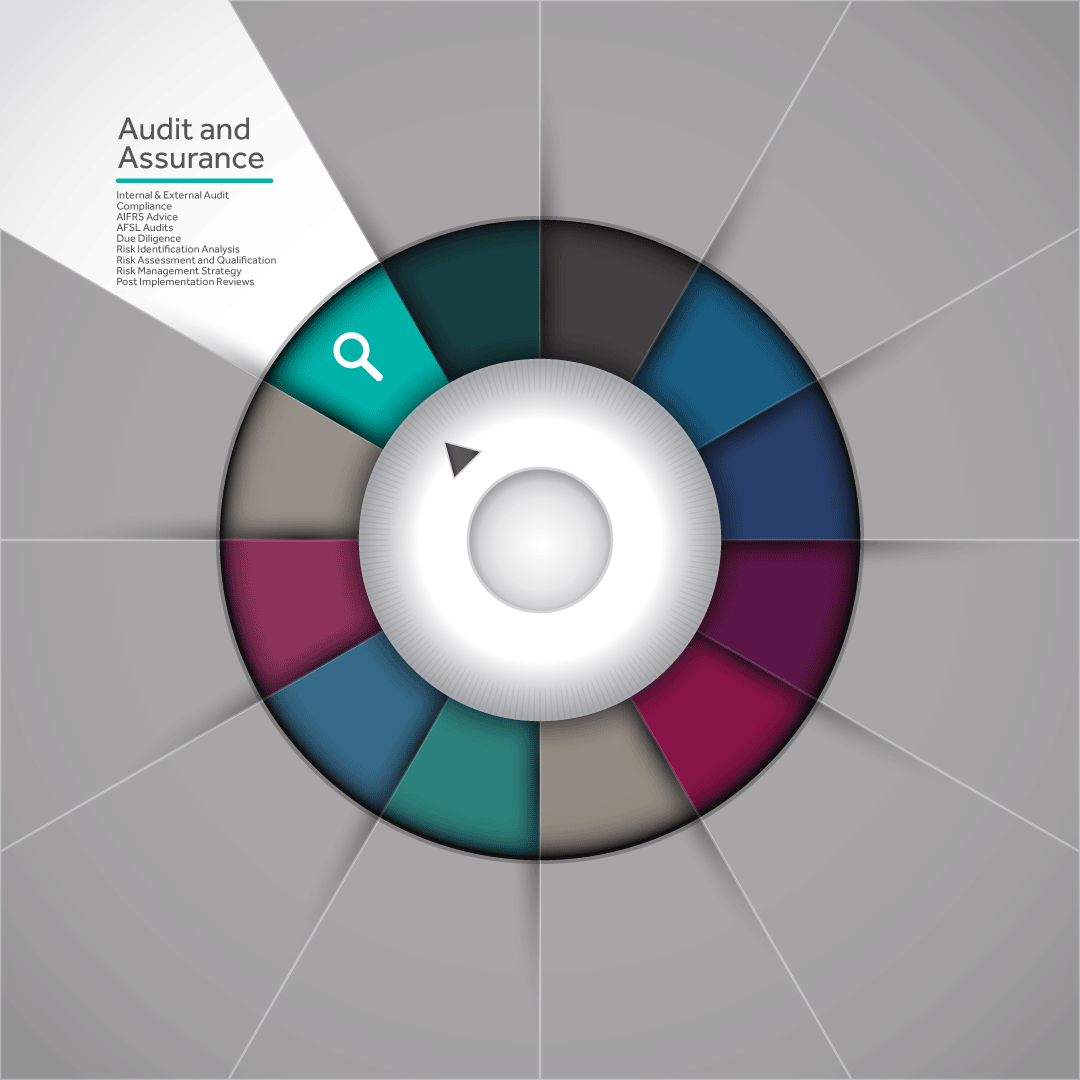

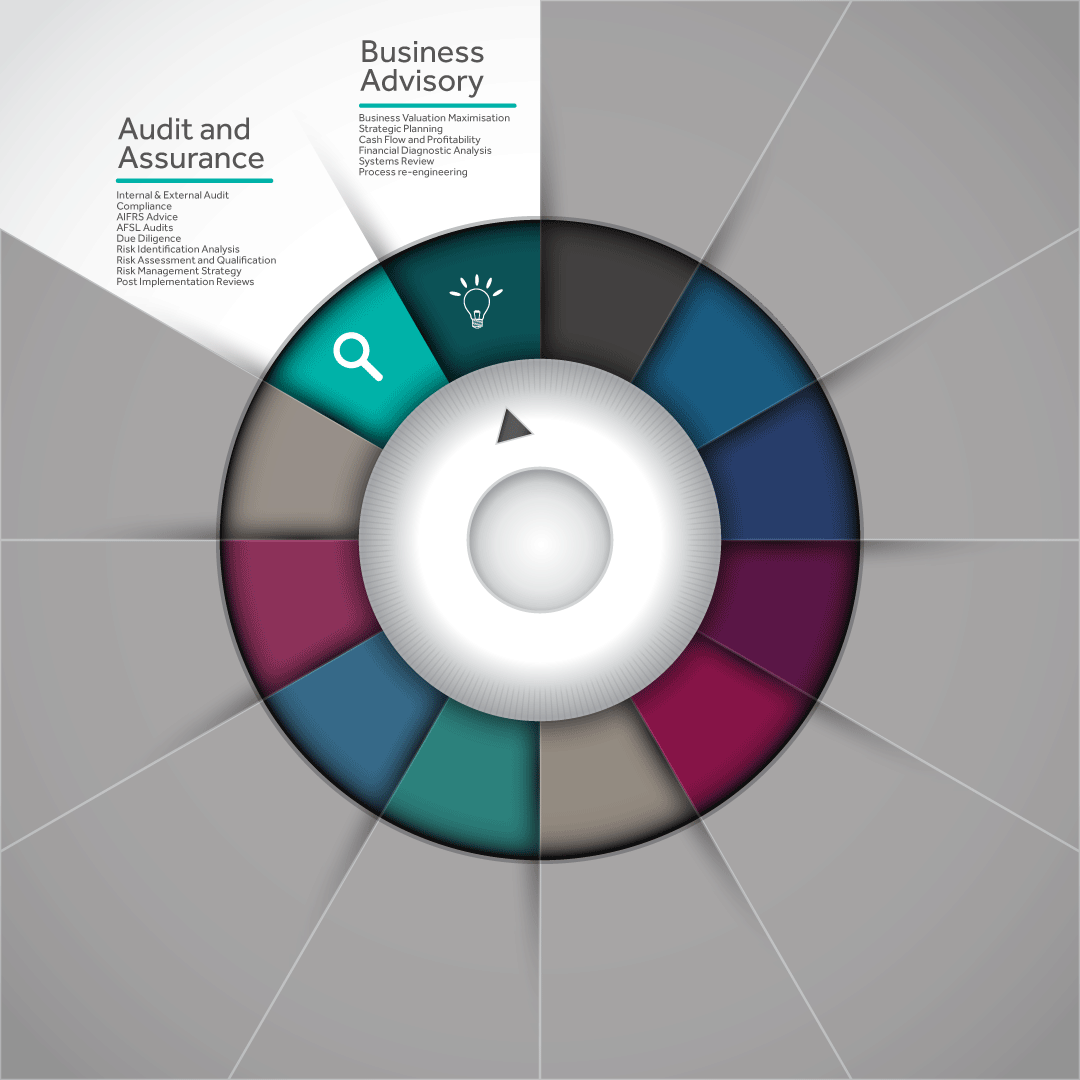

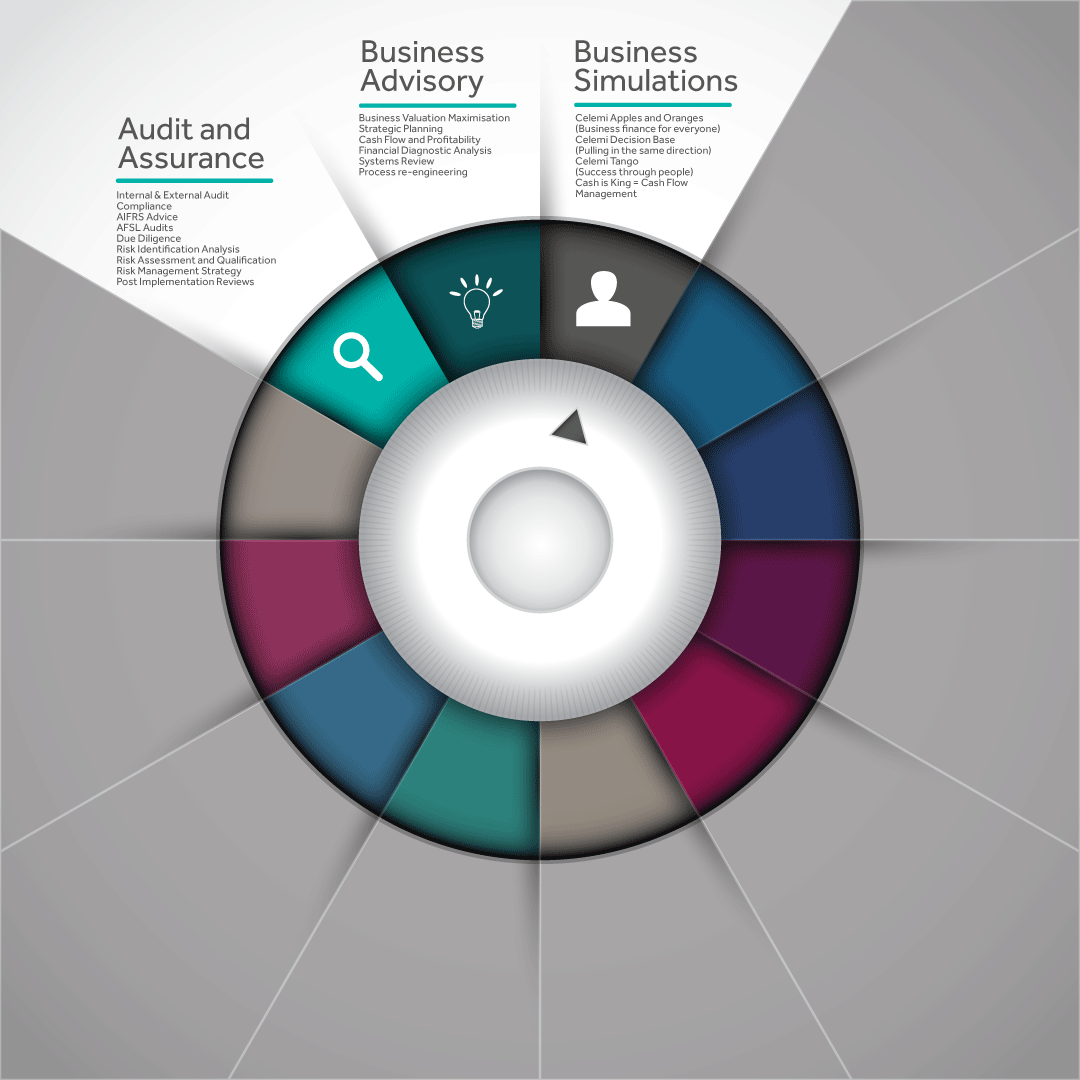

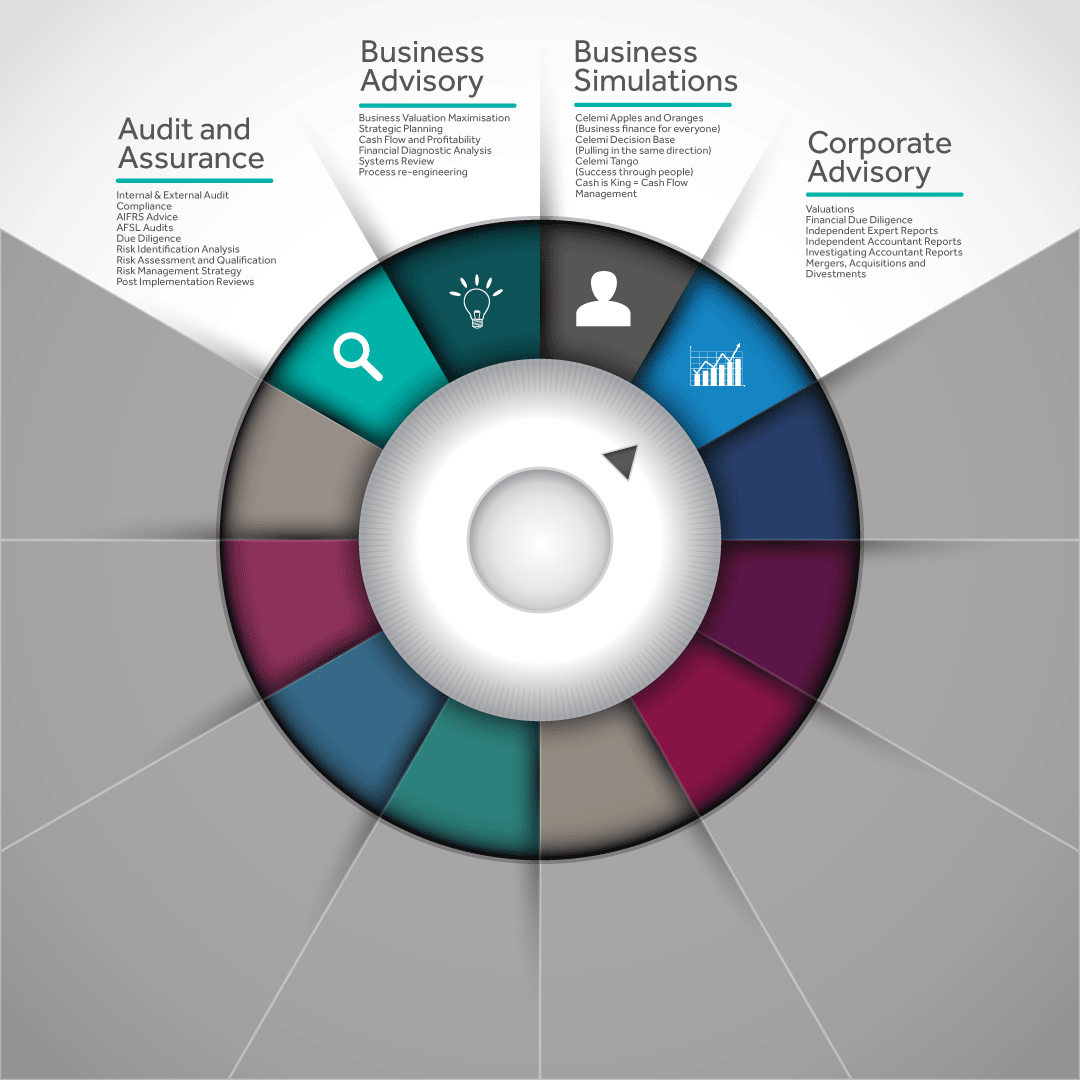

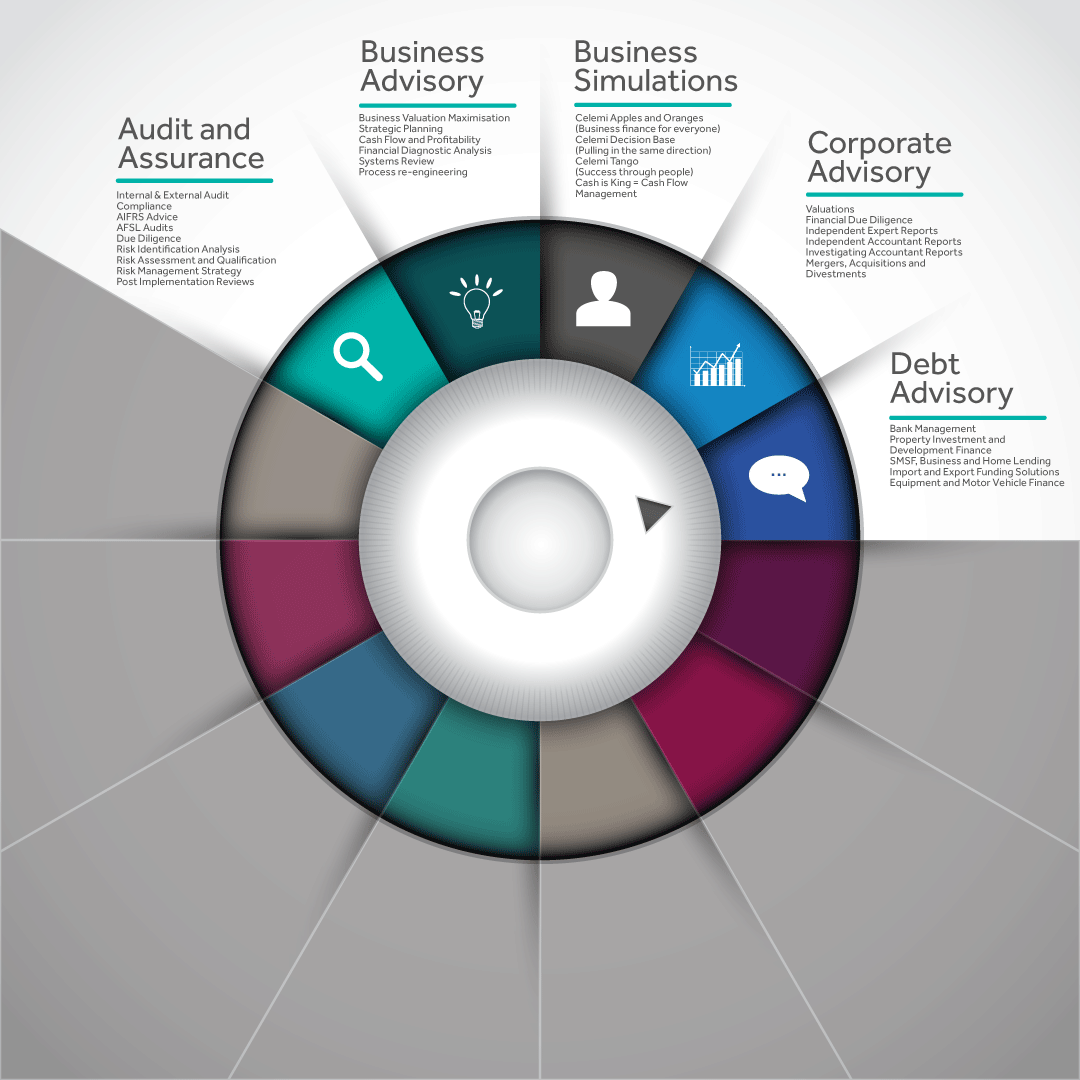

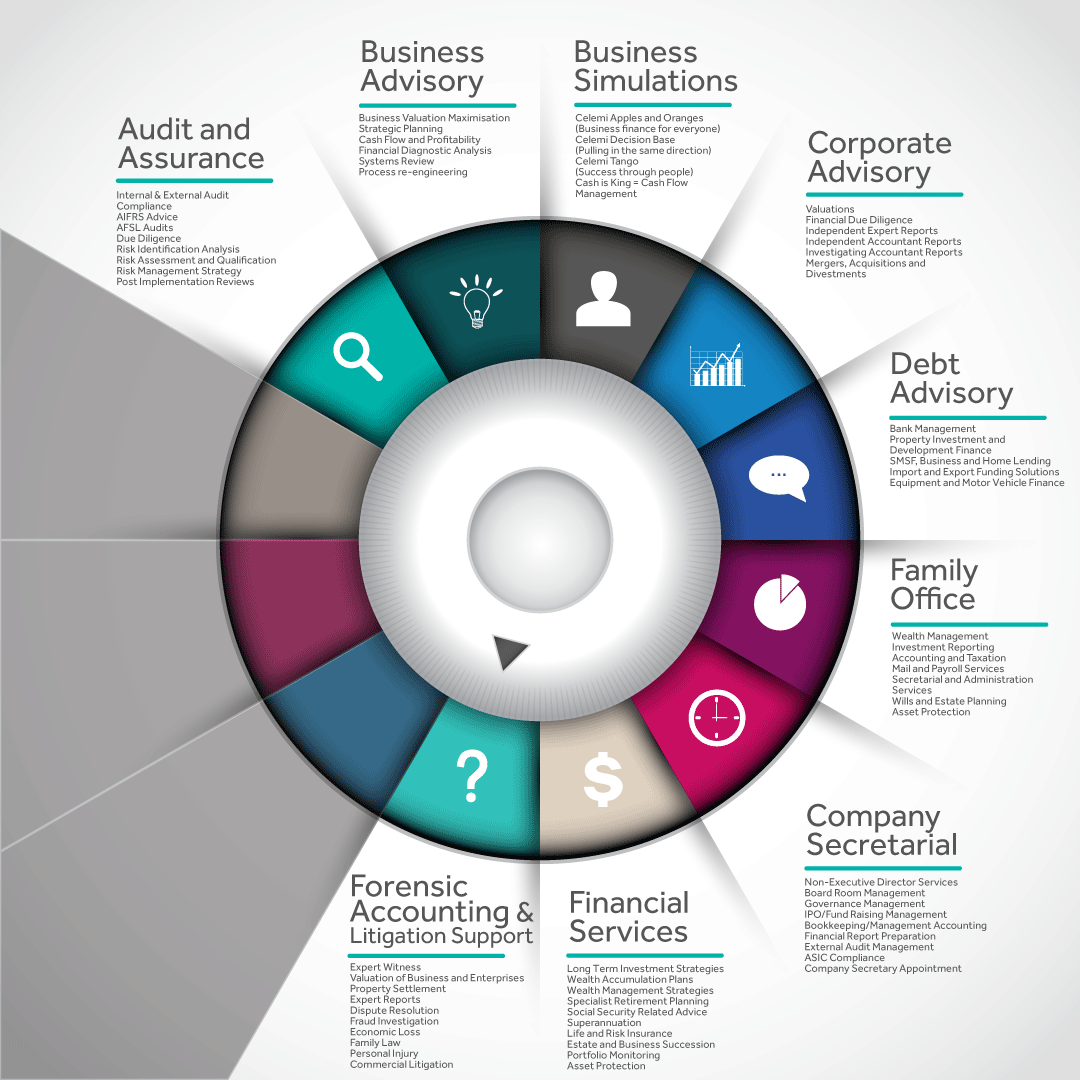

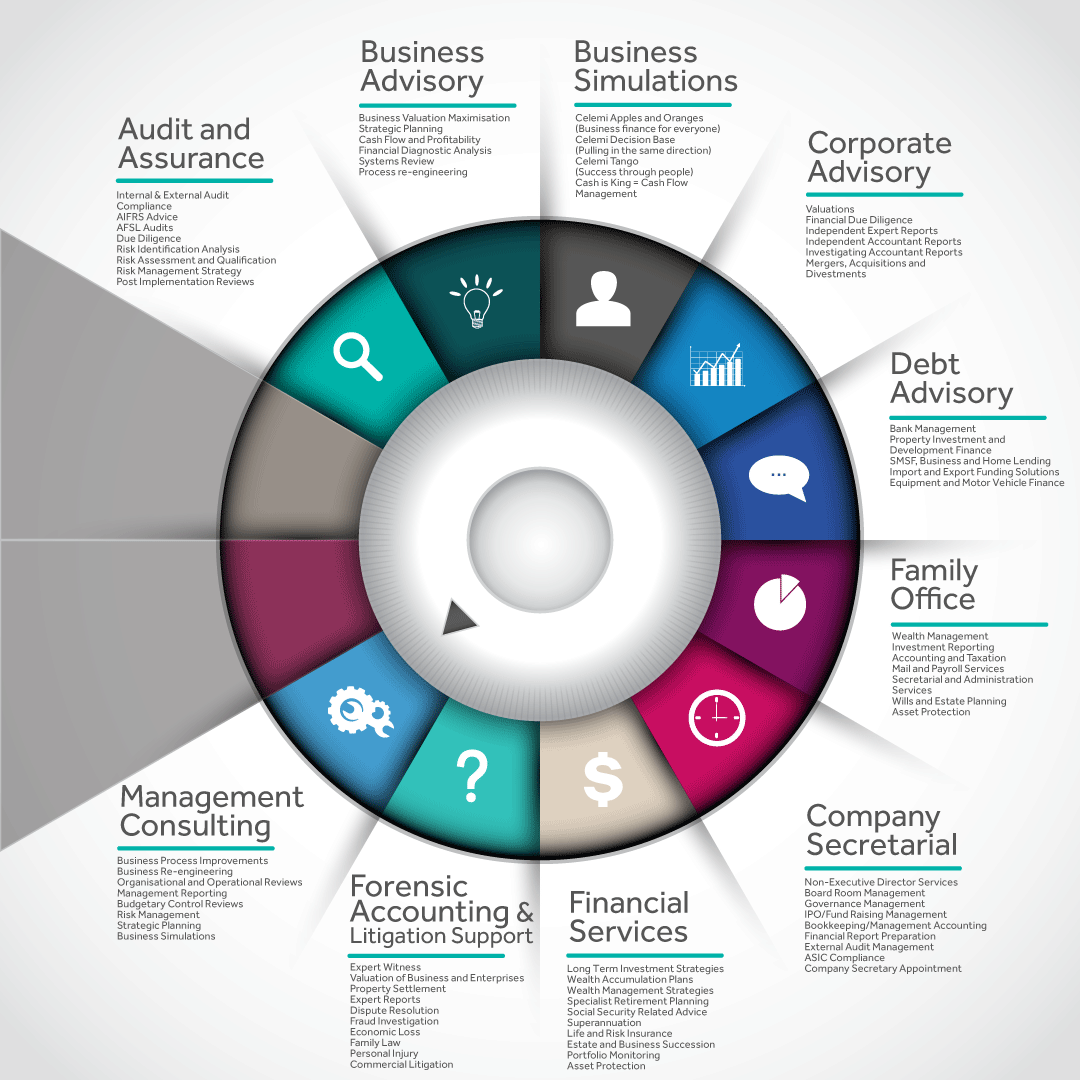

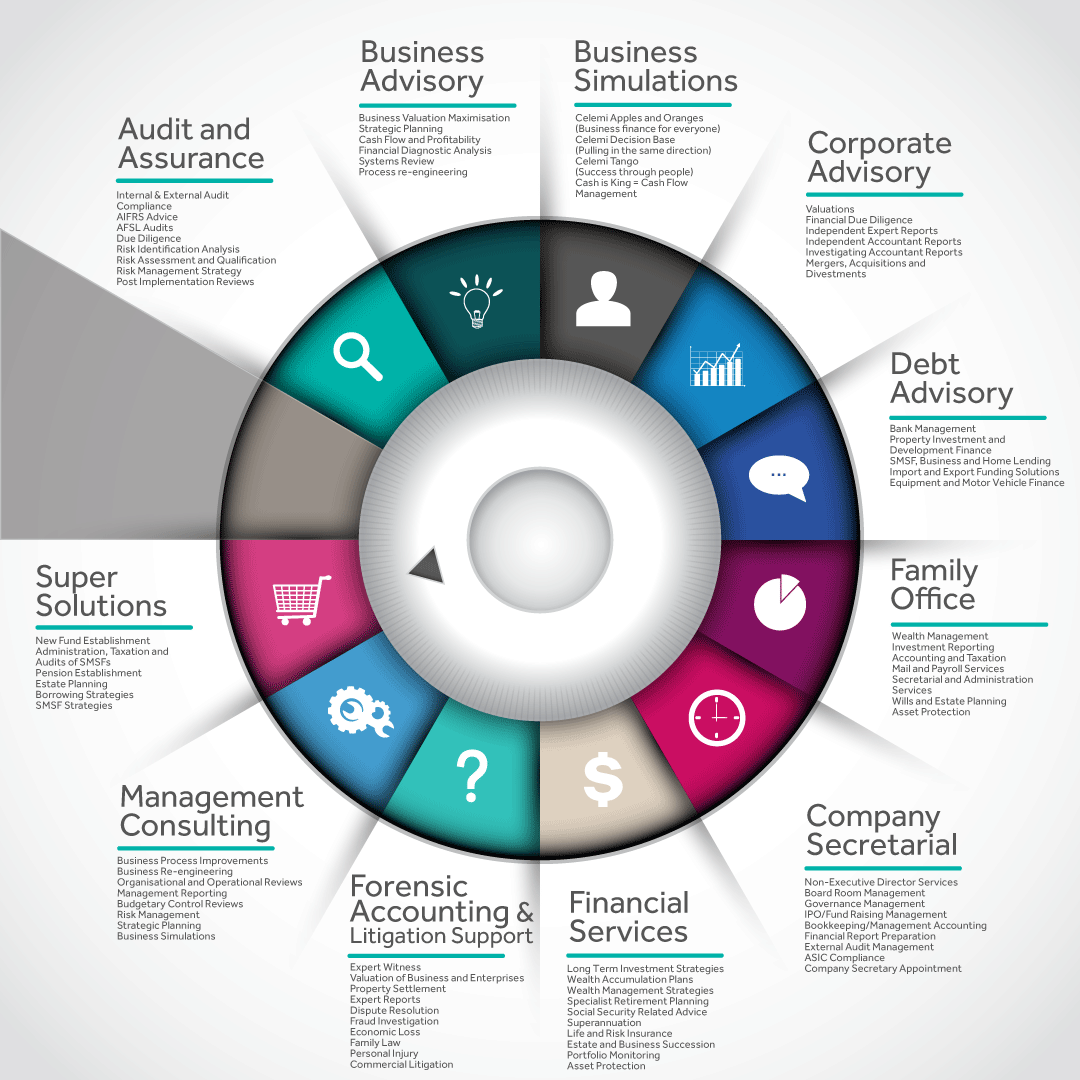

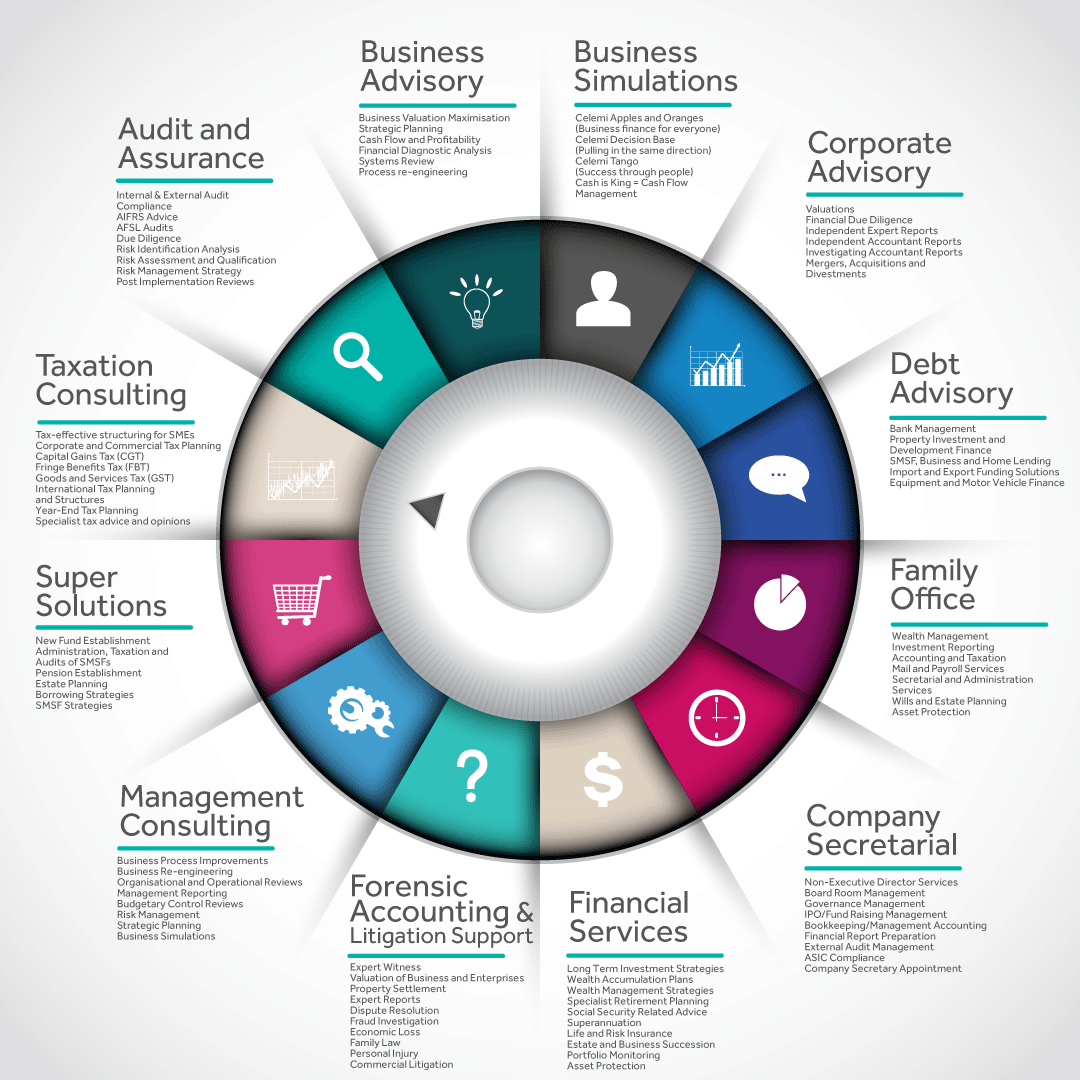

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

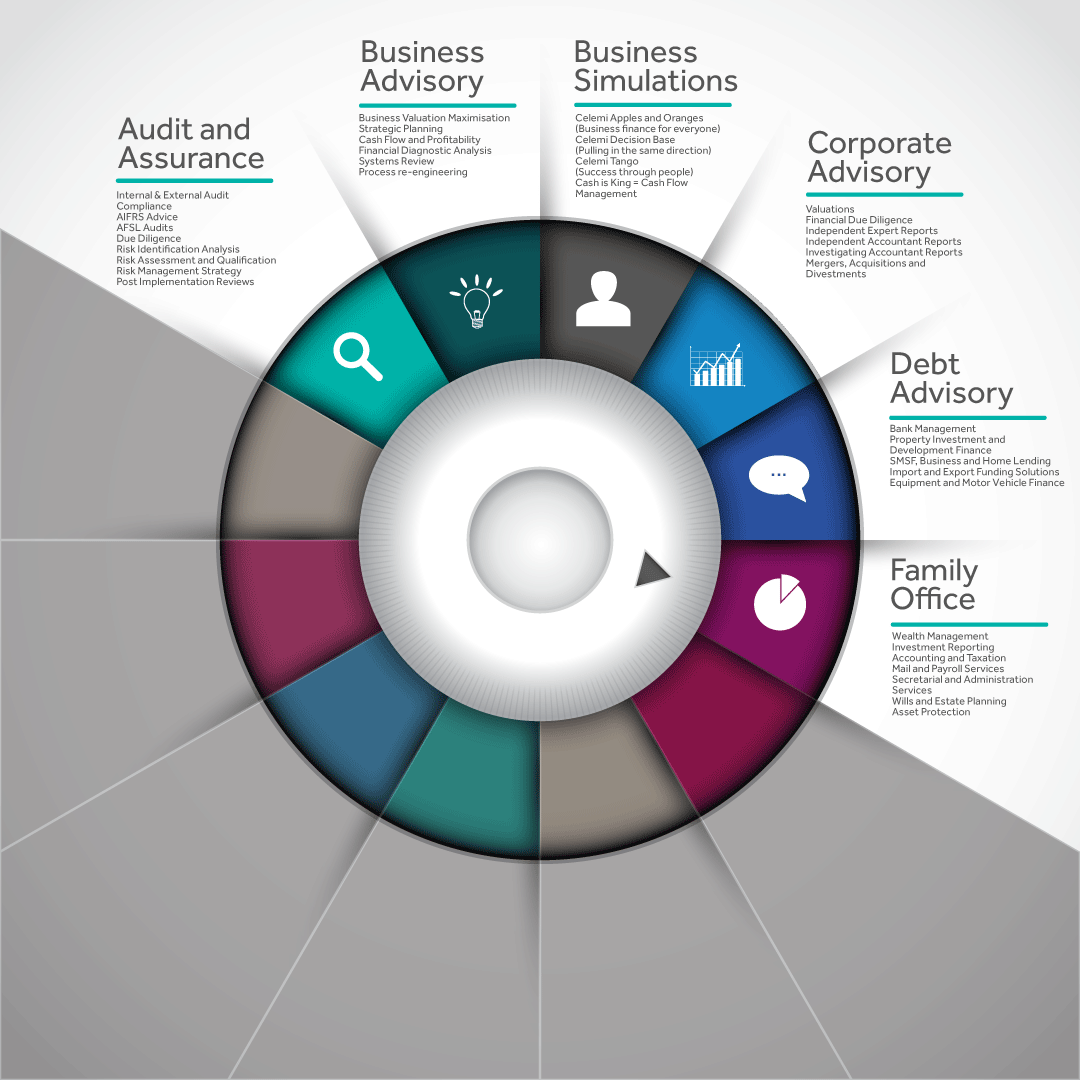

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

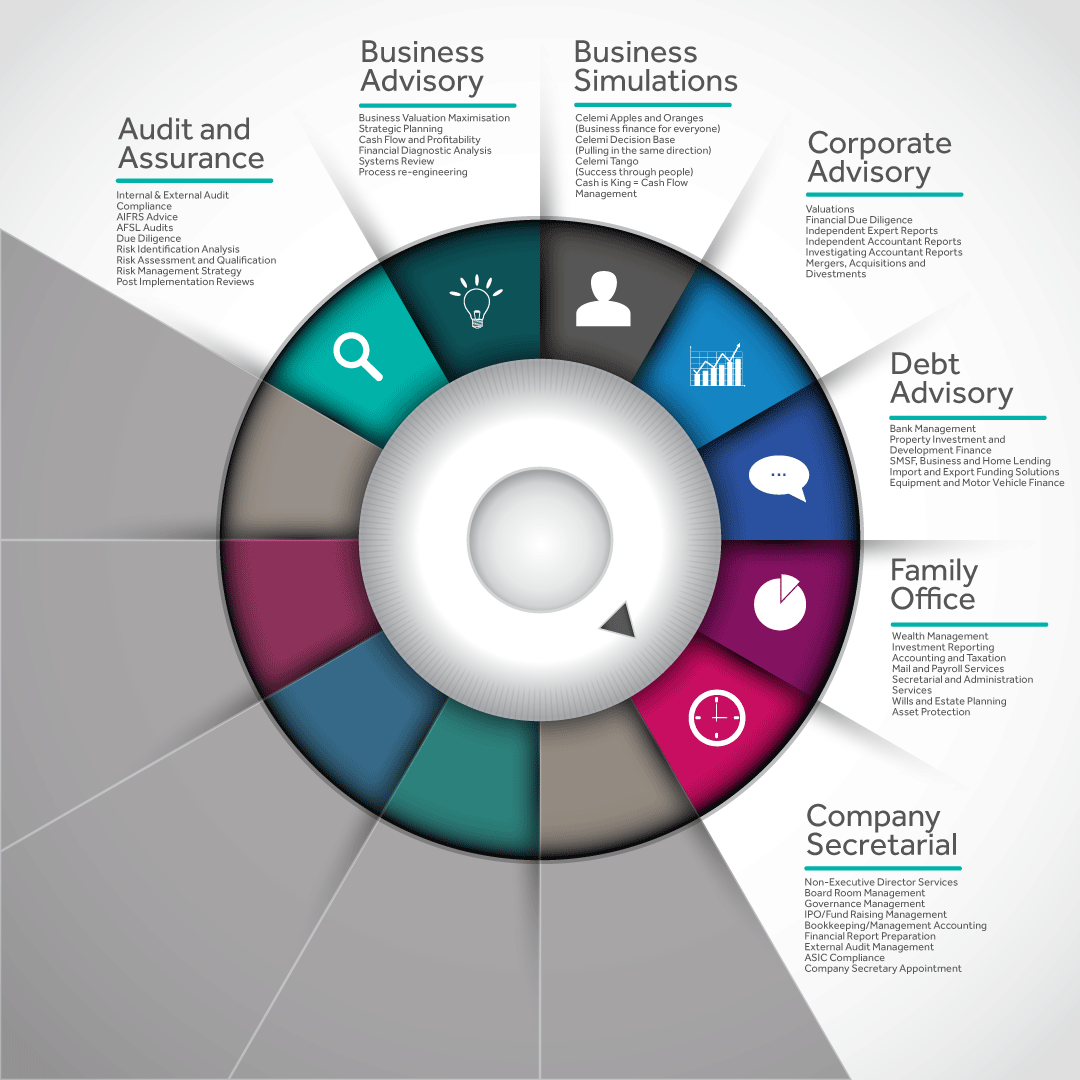

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

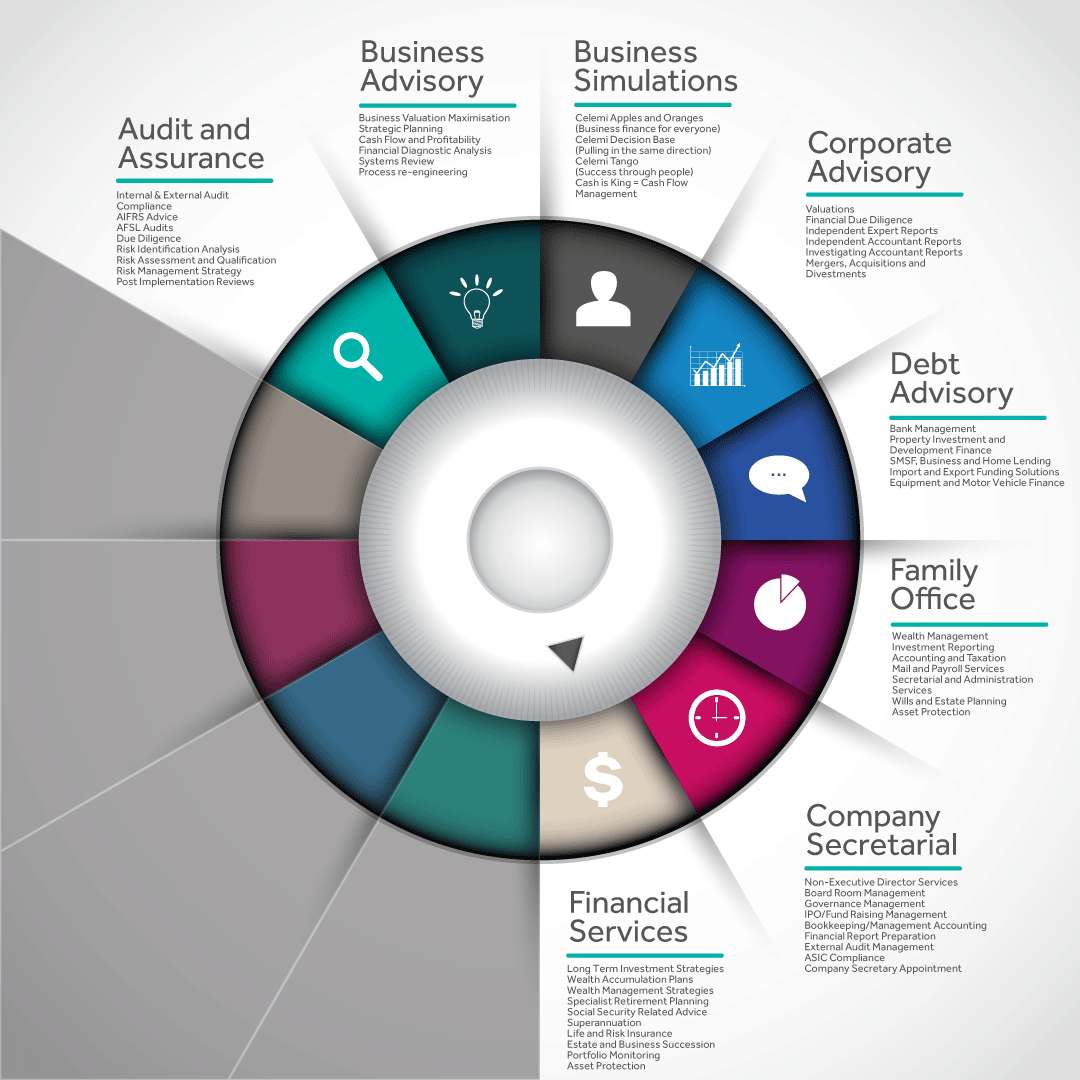

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

(For full sized image, right click and open)

Bridge Building - Part 3

Personal Wealth

Imagine you’re a defendant in an unfairly adjudicated case. Once the ruling has been handed down, without an asset protection strategy in place, what are creditors most likely to seize first? You guessed it: your assets.

Consider asset protection an insurance policy and peace-of-mind safeguard against worst case scenarios.

Wealth accumulation boils down to three things: make it, save it, invest it. Where do you derive income from? Have you considered your day-to-day financial commitments and short-term spending requirements?

These considerations inform your savings plan. We help you monitor your spending, 'trim the fat', make appropriate needs-based adjustments, build contingency plans and formulate a plan to maximise superannuation.

At this point, we put your money to work. We quantify all the elements, ascertain your investment objectives, determine risk and return profiles, construct the optimal portfolio mix, establish cash flow and liquidity and design diversification strategies. This is where we help you 'grow the pie'.

Wealth protection incorporates a variety of products to protect you and the wealth you’ve generated. Considerations include business insurance, income protection, life insurance, total and permanent disability insurance and trauma insurance.

In the event of hardship or misfortune, are you in a position to cover medical expenses, mortgage repayments, debt repayments, and day-to-day living expenses? Similar to asset protection, you’re hedging against unfortunate circumstances.

The way we consume has changed. On demand streaming services deliver viewing experiences in the palm of your hand, social media feeds break frontline global news and online shopping connected to express shipping delivers in days.

With the click of a button, expensive purchases are made and quickly, credit becomes over-extended. Never before has financial literacy and education been more important.

Better understanding leads to more informed decision-making. Do you feel adequately prepared to negotiate the financial landscape, manage risks and avoid financial pitfalls? Can you make sense of rigmarole and complex product options?

"Maybe" isn’t a strong defence.

At the beginning of your voyage, you set out with a goal. Over time, your perspective may change but the motivation to achieve the end result remains. Are you prepared to break a life-time of saving conditioning and suddenly, become a spender? Have you considered the tax implications of drawing down from your superannuation account?

Arriving at your destination isn’t the end, it’s the beginning of a new chapter and thus, it would be wise to plan accordingly.

Ask ten people to define success and you’ll receive ten different answers. That’s the point. Our approach isn’t one-size-fits-all, it’s a your size fits you. When we say partner, it’s not figurative, it’s literal.

Our network is your network and your win is our win. Every day, we come to work in the knowledge that we’re enabling, empowering and encouraging freedom of choice.

That’s our definition of success: let’s partner and accomplish yours.

Disclaimer

To view the full disclaimer click here.

Credits

Project commissioned by Nexia Perth

Story, production and design by Hajduk Consulting

Elements supplied by Envato, Getty Images and Shutterstock

All video and images subject to copyright

Publication date: 31 August, 2018